"Bitcoin ETF Approval Sparks Surge in Crypto Trading Volume"

TL;DR Summary

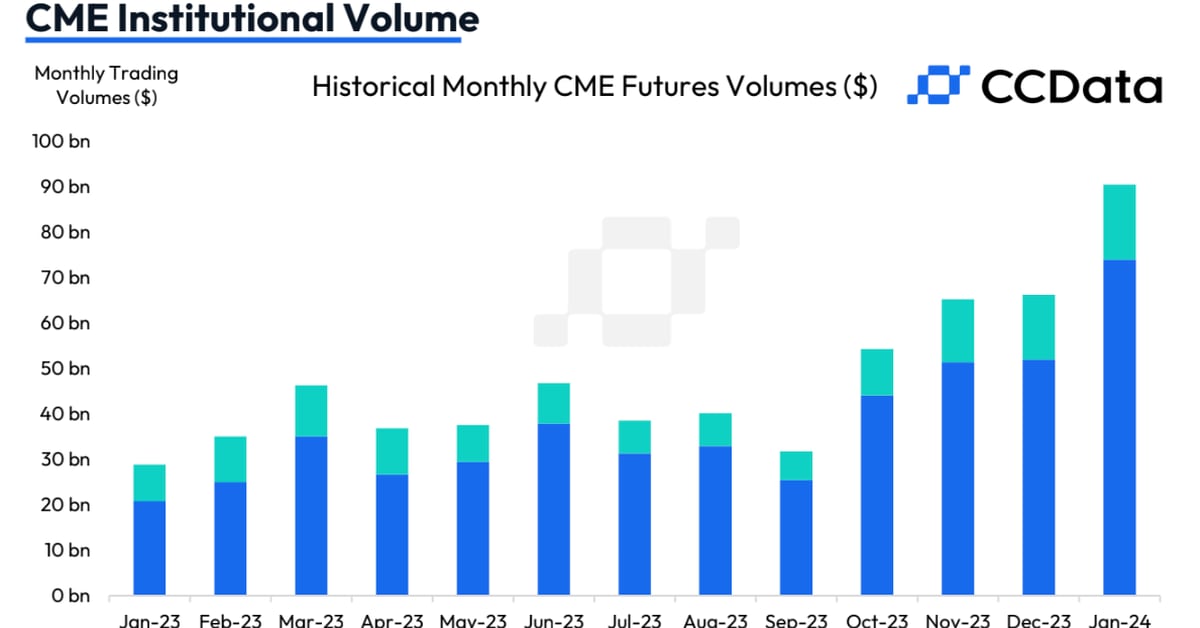

Chicago Mercantile Exchange (CME) experienced a 35% surge in trading volume in January, reaching $94.9 billion, the highest in three years, following the approval of spot bitcoin exchange-traded funds (ETFs) in the U.S. The rise in futures volume and decline in options volume suggests institutional investors are winding down their positions after the ETF approval. Additionally, the volume of bitcoin futures open interest surpassed Binance but has since fallen, while ether futures and options trading volumes on CME also saw increases.

Topics:business#bitcoin-etf#cme#derivatives#financebitcoin-trading#institutional-investors#trading-volume

- CME Trading Volume Reached Highest in 3 Years After Bitcoin ETF Approval CoinDesk

- Crypto Trading Hits Busiest Pace Since June 2022 CoinDesk

- New bitcoin ETFs are boosting crypto exchanges. Here's how. MarketWatch

- Wall Street Gets Laser Eyes in Bid for Bitcoin ETF Bucks The Wall Street Journal

- Grayscale CEO urges regulators to approve listed options for spot Bitcoin ETFs Cointelegraph

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

1 min

vs 2 min read

Condensed

77%

349 → 81 words

Want the full story? Read the original article

Read on CoinDesk