US Regional Bank Stocks Plunge Amid PacWest's Consideration of "All Options".

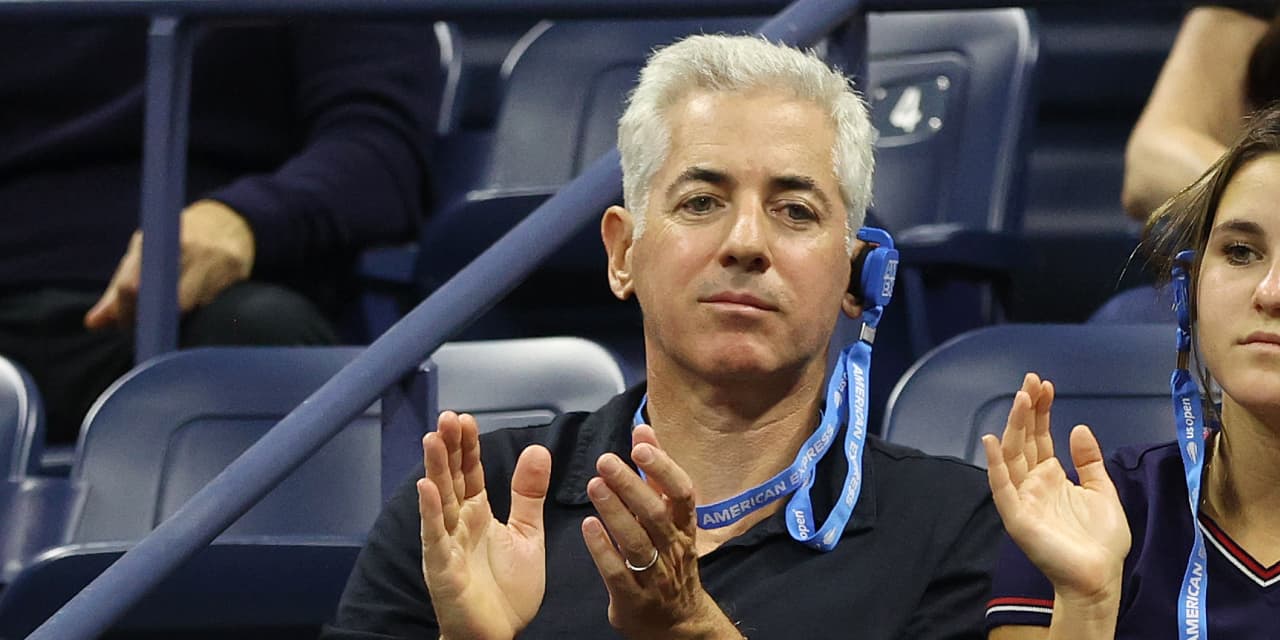

PacWest Bancorp's stock plunged nearly 42% to a new low triggering another day of selling in regional bank shares. The bank said it was in discussions with partners and investors and that the talks were ongoing. Shares of other regional lenders were also lower Thursday. Activist investor Bill Ackman called for a systemwide deposit guarantee regime to be implemented, adding “we are running out of time to fix this problem.”