Novartis's $12B Avidity Deal Boosts Biotech Stocks and Neuroscience Pipeline

Novartis' CEO indicated that their $12 billion acquisition of Avidity BioSciences could have been twice as large, highlighting the significance of timing in deal-making.

All articles tagged with #deal making

Novartis' CEO indicated that their $12 billion acquisition of Avidity BioSciences could have been twice as large, highlighting the significance of timing in deal-making.

Wall Street experienced one of its most profitable quarters driven by soaring stock prices, strong earnings from major banks like JPMorgan Chase, Citigroup, Wells Fargo, and Goldman Sachs, and a vibrant deal-making environment, despite ongoing economic uncertainties and geopolitical tensions.

In June, family offices increased their investment activity, making 60 direct investments, particularly in biotech and healthcare firms like Antheia, driven by a desire for impactful and profitable scientific breakthroughs, leveraging their patient capital.

OpenAI has completed a deal that values the company at $80 billion, nearly tripling its valuation in less than 10 months. The deal, led by venture firm Thrive Capital, allows employees to cash out their shares in a tender offer, providing an important vote of confidence for the company after a year of controversy. This funding boom reflects the Silicon Valley deal-making machine's focus on companies specializing in generative A.I., with OpenAI now one of the world's most valuable tech start-ups.

Morgan Stanley's second quarter earnings slid 12% due to a slowdown in deal making, but the investment bank still managed to exceed expectations.

Citigroup is set to report its earnings on Friday, with expectations tempered due to weak deal making activity. The bank's stock price will be closely watched as investors assess the impact of the lackluster deal making environment on its financial performance.

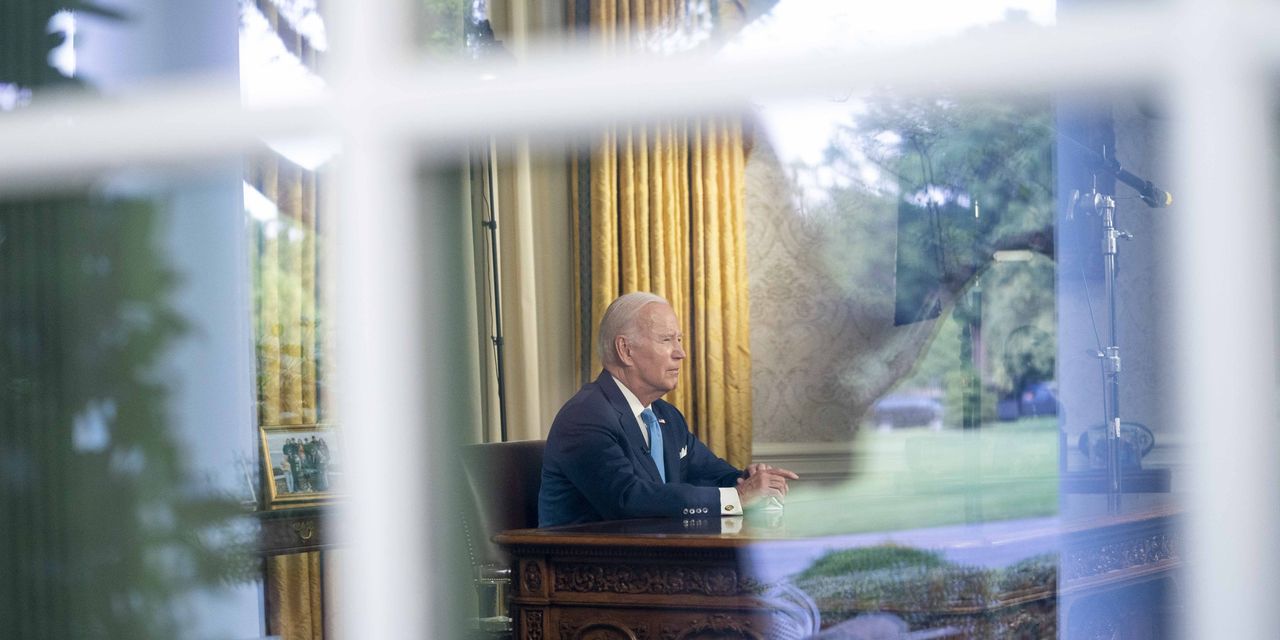

President Biden is relying on his deal-making skills to avoid crises as his poll numbers remain stalled. He is working to pass his infrastructure and social spending bills, while also navigating challenges such as the pandemic, inflation, and foreign policy issues. Biden's leadership style emphasizes collaboration and compromise, but he faces opposition from Republicans and some Democrats, which could make it difficult to achieve his goals.

Morgan Stanley's Q1 profit fell 19% YoY to $2.98 billion, or $1.70 a share, due to a slowdown in deal making. However, the bank beat analysts' expectations of $1.63 a share. Morgan Stanley is a major player in Wall Street's trading and deal-making businesses.

Morgan Stanley's first-quarter profit dropped by 19% due to a slowdown in deal making. The company reported earnings of $3 billion, or $1.70 a share, on revenue of $14.5 billion, beating estimates.