Ives Unveils 10 Catalysts to Reignite Tech Stocks Amid AI Selloff

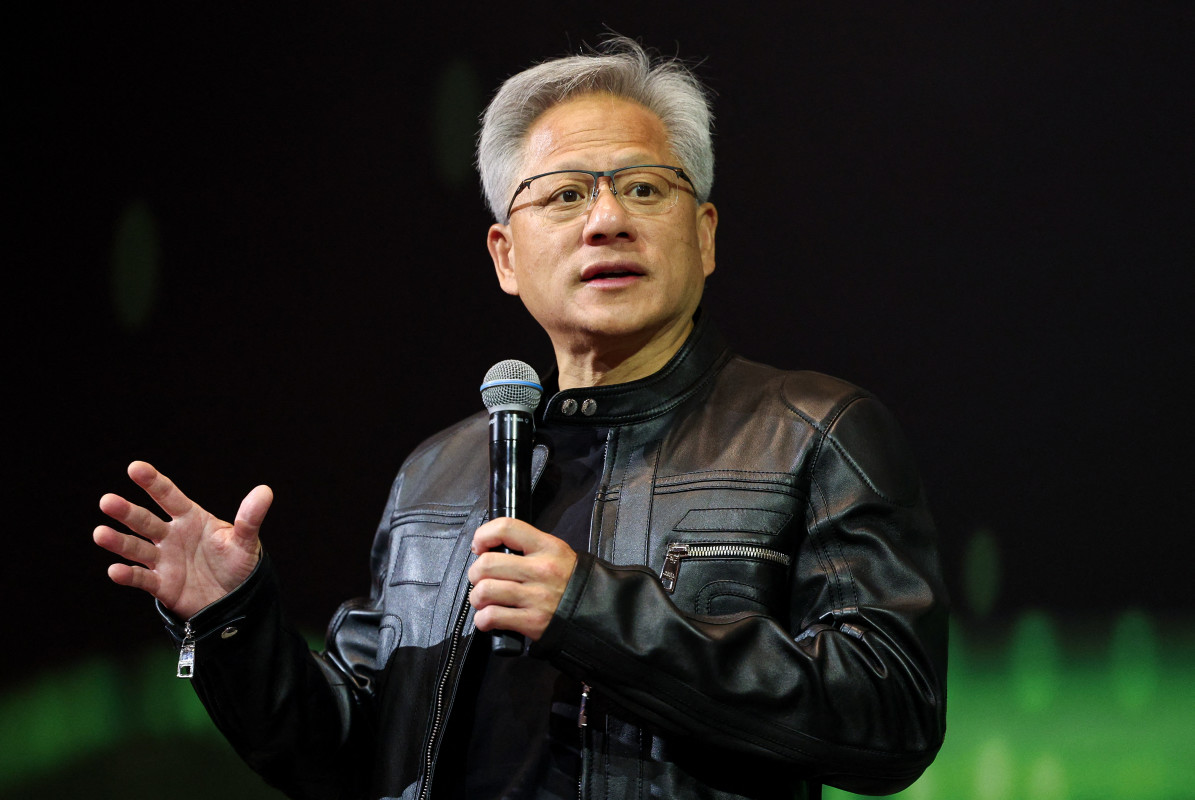

Wedbush analyst Daniel Ives calls the tech-sector pullback the “AI Ghost Trade” and outlines 10 catalysts to reverse it, including OpenAI funding closure, Nvidia AI demand, Oracle capital raises, Salesforce AI monetization, increased M&A, Apple's Siri AI rollout, CrowdStrike AI monetization, and AI monetization from Microsoft/ServiceNow and Meta/Alphabet; the piece also notes several AI names carry a Strong Buy consensus among analysts.