U.S. Supports Argentina's $20 Billion Bailout Amid Peso Decline and Political Tensions

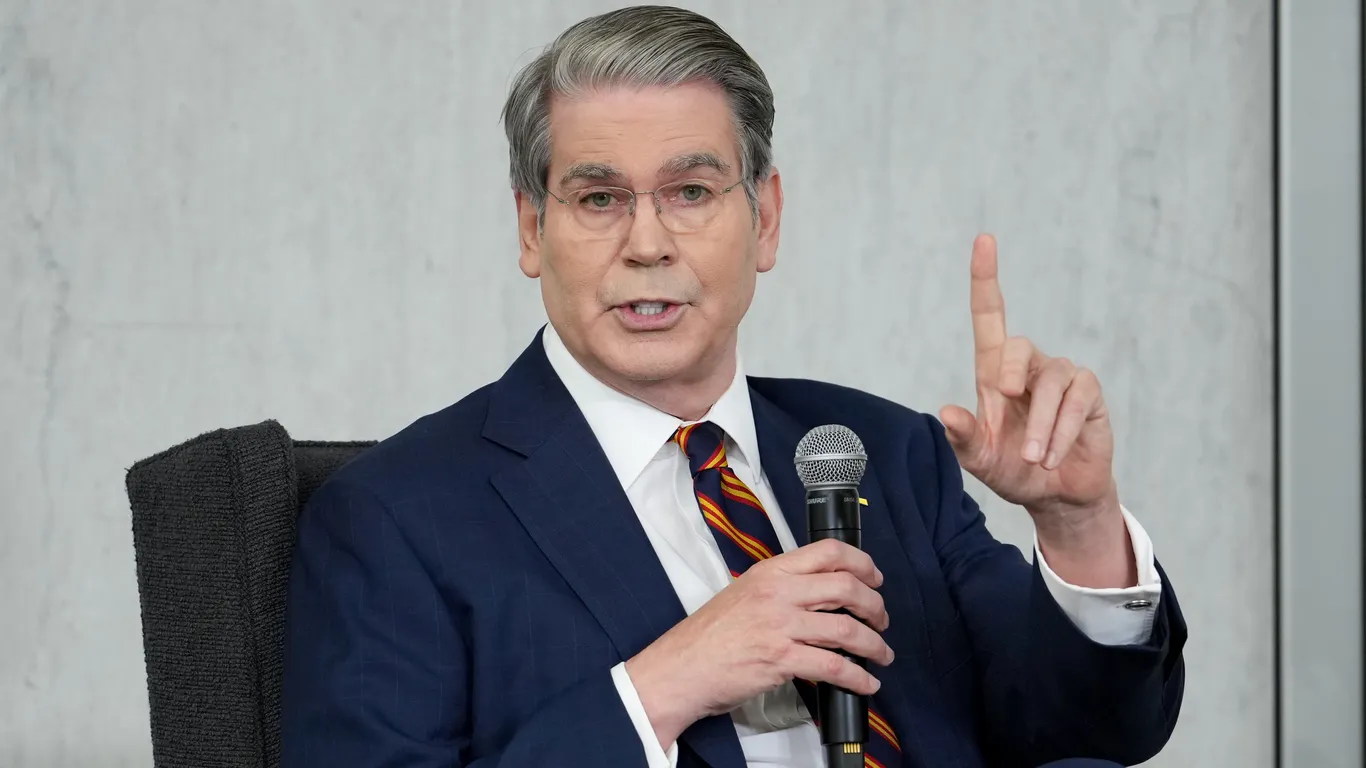

Treasury Secretary Scott Bessent defended the $20 billion currency swap with Argentina during the government shutdown, emphasizing its importance for national security and global financial stability, despite questions from Senator Elizabeth Warren about private-sector involvement and the effectiveness of the aid.