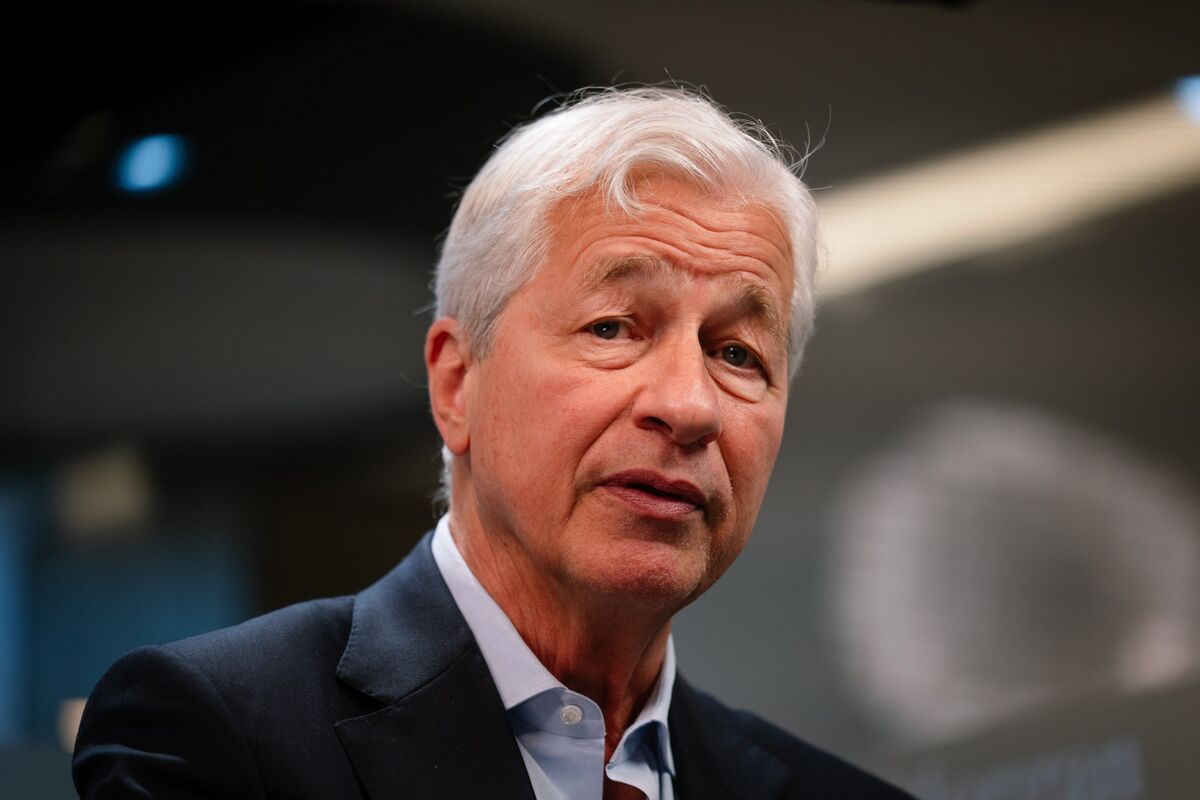

JPMorgan Profit Dips as Rates Fall and Apple Card Deal Adds Headwinds

JPMorgan Chase posted 2025 earnings of $57 billion, down from 2024’s record $59 billion, due to lower interest rates squeezing net interest income, higher reserves for loan losses, and costs from acquiring Apple’s branded credit card; fourth-quarter profit fell 7% to $13 billion, while CEO Jamie Dimon signaled potential long-term benefits from deregulation and policy as headwinds persist.