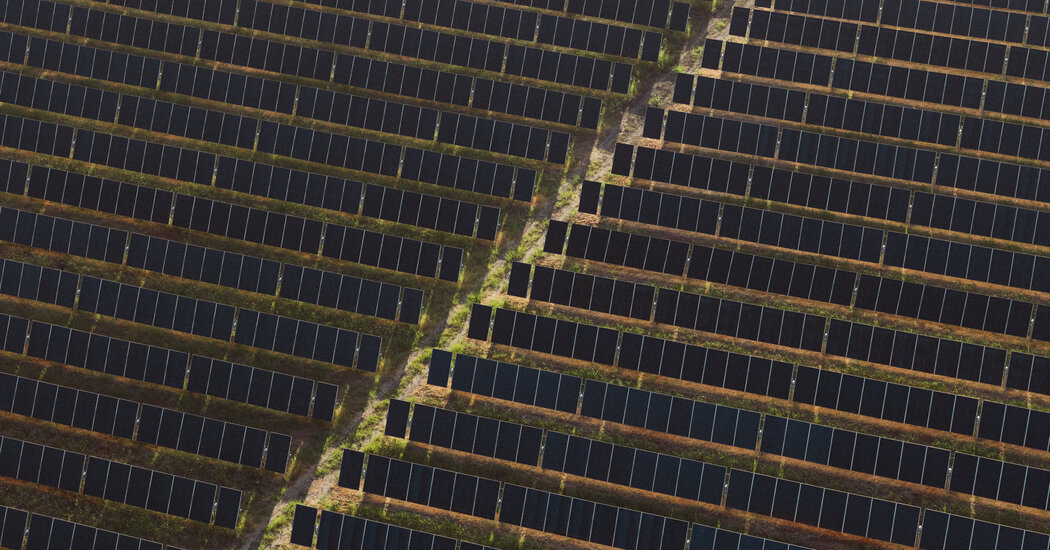

"Tax Credits in Climate Bill Attract Solar Manufacturing to U.S., but Imports Pose Threat to Boom"

Solar manufacturing in the United States is experiencing a revival thanks to a combination of tax credits and trade protections provided by President Biden's Inflation Reduction Act. The law has incentivized solar companies to invest billions of dollars in new facilities, leading to the reshoring of solar jobs. Critics argue that while these efforts have been successful in the short term, they come at a high cost to taxpayers and may not be sustainable in the long run. However, proponents believe that the subsidies and tariffs are necessary to compete with China and build a robust domestic solar industry.