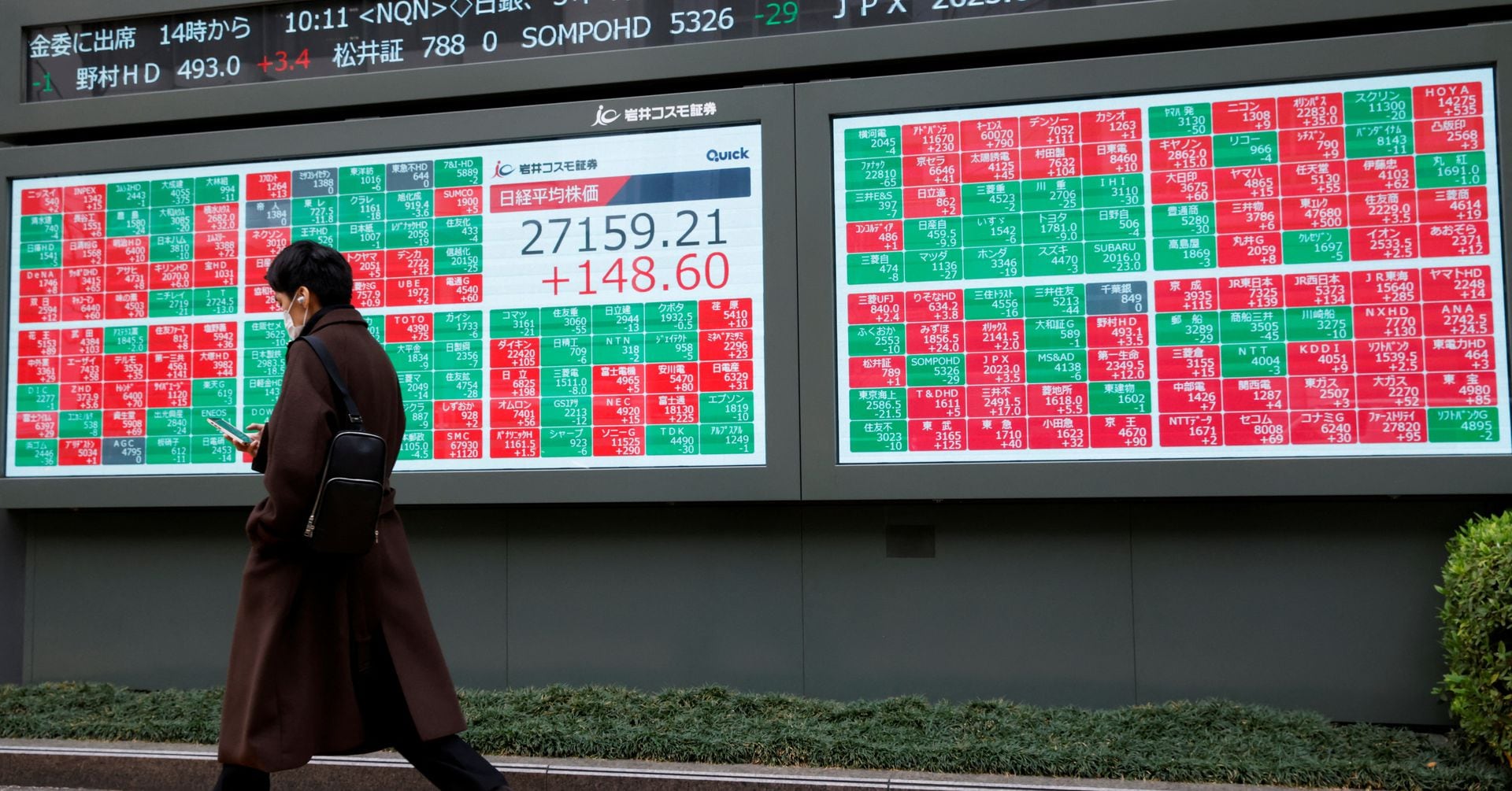

Nikkei hits record as stimulus bets lift Japan, China caps gains with margin rule

Japan’s Nikkei 225 climbed to a record as bets on additional fiscal stimulus buoyed markets, with the TOPIX also rising, while China capped gains by raising the minimum margin for stock purchases to 100%, making margin-financed buying more expensive and dampening momentum even as China posted a record trade surplus and supported AI-related activity.