"Mitigating Check Fraud: A 2024 Resolution to Stop Using Paper Checks"

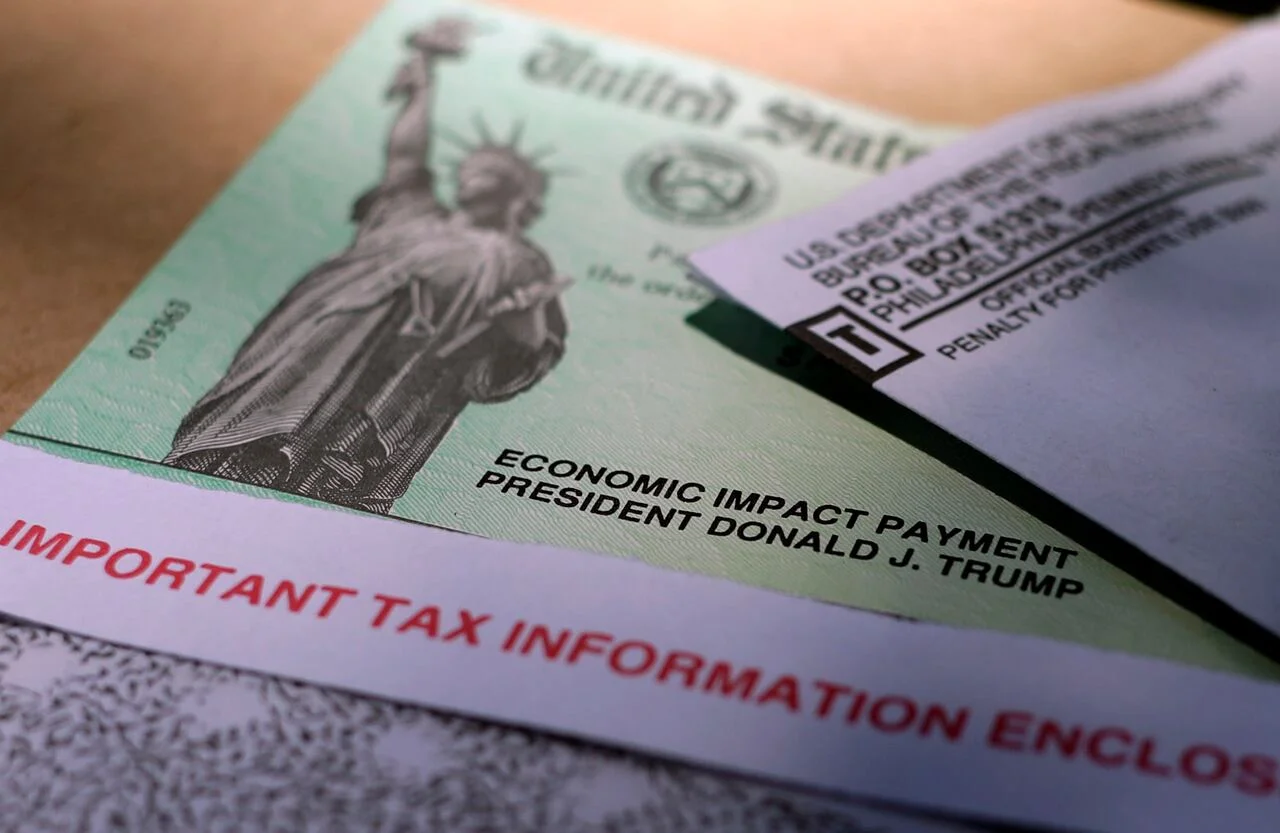

Despite the decline in check usage, check fraud is on the rise, costing financial institutions billions. Tips for writing checks safely include using gel pens, keeping a separate account for check writing, and mailing checks securely. Banks offer various protections, such as flagging unusual checks and secure online bill-payment services. Person-to-person payment platforms like Zelle and Venmo are convenient but come with risks, so users should transact with caution and verify recipients' identities.