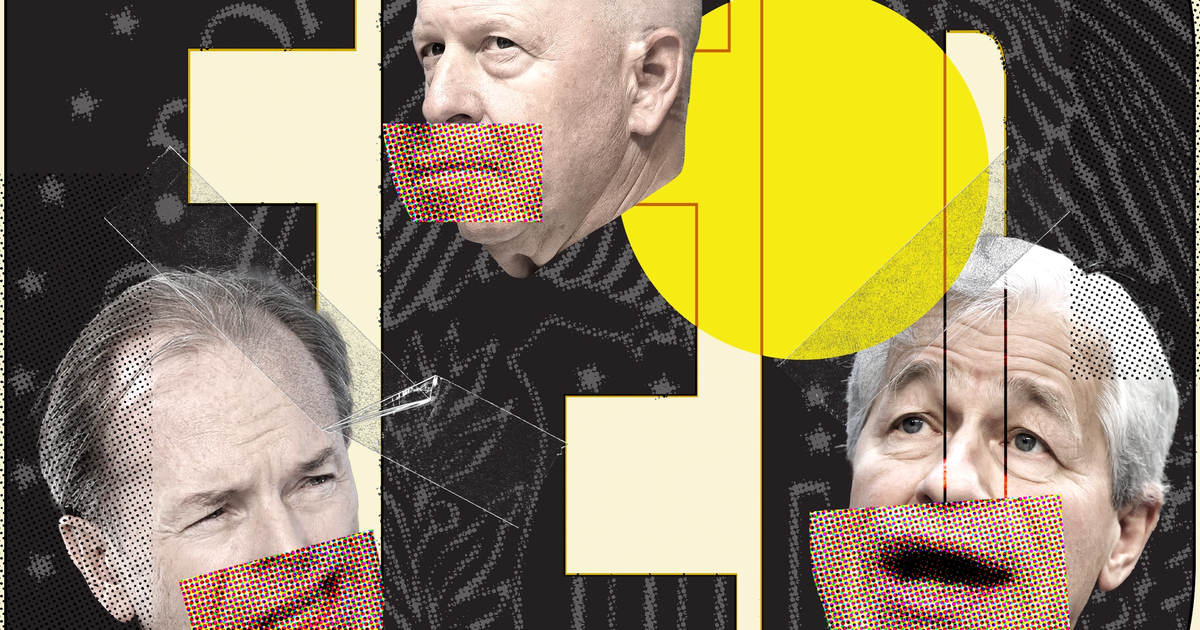

"Unintended Consequences: Big US Banks Seek Rewrite of Capital Rules to Ease Impact on Small Businesses and Borrowers"

The article discusses the potential unintended consequences of the Basel endgame, highlighting concerns about the impact on global banking regulations and financial stability. It explores how the finalization of Basel III rules could affect the global economy and the banking sector, raising questions about potential risks and challenges that may arise as a result.