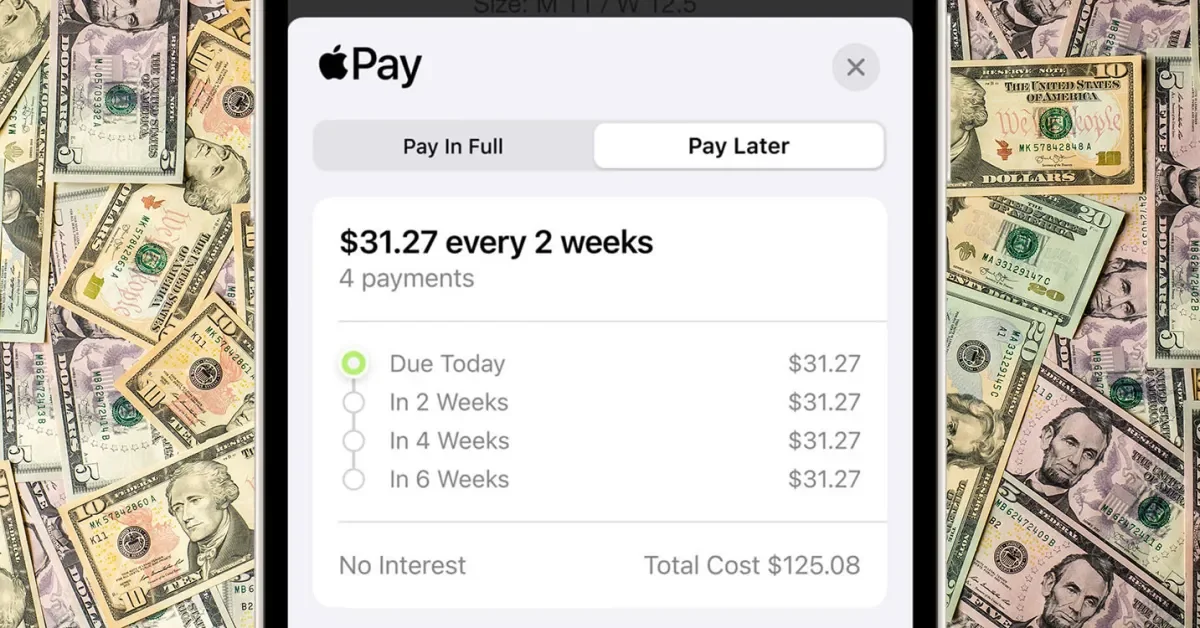

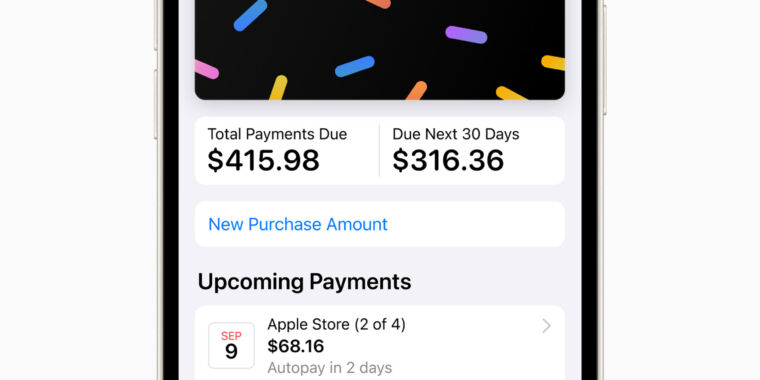

Apple Pay Later Expands Nationwide, Now Accessible to All U.S. Users

Apple Pay Later, a "buy now, pay later" feature, has officially launched in the U.S. for qualifying residents, following an early access period. The feature allows eligible customers to split purchases made with Apple Pay into four equal payments over six weeks, with no interest or fees. The minimum purchase amount has been raised to $75, and each purchase requires a new application. Apple Pay Later is available on the Wallet app for iPhone and iPad, with loan management features and payment reminders. However, it is currently unavailable in certain states and U.S. territories.