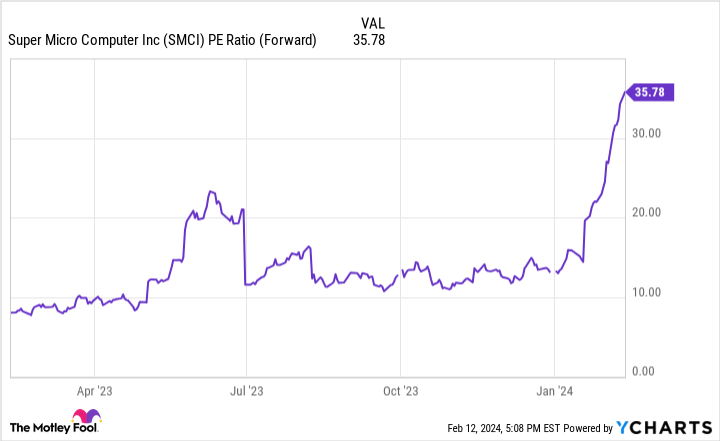

Stock Markets Rise Amid Mixed Economic and Corporate News

The stock market saw modest gains despite negative jobs data, with a notable surge in an AI stock, Nebius Group, following a major deal with Microsoft. Apple declined ahead of its product launch, while other stocks like UnitedHealth and Nvidia performed well. Economic indicators showed a slight improvement in small business optimism, and key tech stocks experienced mixed movements amid ongoing market developments.