Dow Hits Record High as Coca-Cola and 3M Surge

The Dow Jones Industrial Average closed at an all-time high, driven by significant gains in Coca-Cola and 3M stocks.

All articles tagged with #3m

The Dow Jones Industrial Average closed at an all-time high, driven by significant gains in Coca-Cola and 3M stocks.

3M reported better-than-expected Q2 2025 results with $6.3 billion in sales and raised its full-year guidance, driven by growth in electronics and industrials, improved margins, and strategic cost management, despite tariff and foreign exchange headwinds.

3M's stock surged after reporting strong Q2 2025 earnings with adjusted EPS of $2.16 and revenue of $6.3 billion, both beating estimates. The company raised its full-year guidance and remains a 'Moderate Buy' on Wall Street, with a slight potential downside in stock price.

Several stocks are experiencing significant premarket movements, including Micron Technology, 3M, AT&T, and Delta Airlines.

3M has completed the spin-off of its healthcare business, officially launching Solventum Corporation as an independent company listed on the New York Stock Exchange as SOLV. Holders of 3M common stock received one share of Solventum common stock for every four shares of 3M common stock held. 3M retained 19.9% of the outstanding shares of Solventum common stock, which will be monetized within five years following the spin-off. The distribution is generally intended to be tax-free to 3M shareholders for U.S. federal income tax purposes.

On Tuesday, Southwest Airlines and Asana stocks fell due to capacity cuts and a disappointing earnings forecast, while Oracle and 3M stocks rose after beating profit forecasts and appointing a new CEO. Additionally, Archer Daniels Midland announced a stock buyback program, Advance Auto Parts named new board members, and American Airlines warned of negative impacts from rising fuel costs.

3M has appointed Bill Brown, former CEO of L3Harris Technologies, as its new CEO in an effort to navigate through slowing sales and legal challenges. The company's shares surged nearly 7% following the announcement. Brown, known for driving margin and efficiency, will take over from current CEO Michael Roman on May 1. 3M has been facing a tough macro environment and legal issues, including settling lawsuits related to earplugs and "forever chemicals."

3M announces new leadership appointments, with William M. "Bill" Brown appointed as the chief executive officer, effective May 1, 2024, succeeding Michael Roman, who will take on the role of Executive Chairman of the 3M Board of Directors. Brown, the former Chairman and CEO of L3Harris Technologies, brings a wealth of experience in strategic leadership and innovation to 3M. Roman will continue to chair 3M's Board of Directors as executive chairman, providing insights from his more than 35 years with the company. The Board of Directors waived the mandatory retirement age of 65 years for both Roman and Brown.

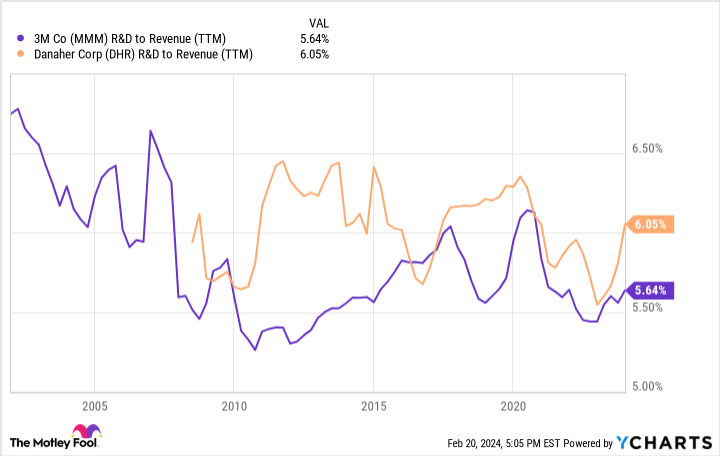

3M stock has plummeted 65% since 2018, raising questions about its potential as a buy-and-hold opportunity. The company's diversified business model and high-margin products make it an attractive long-term investment, but declining research and development spending and mounting debt levels pose challenges. 3M faces significant legal liabilities, including multi-billion dollar settlements, which may impact its financial position and ability to invest in innovation. While the stock still holds value, potential investors should consider the long-term horizon and management's ability to address these issues.

3M, a Dividend King with a 65-year streak of raising dividends, has seen its stock price weaken, leading to a high dividend yield of 6.3%. Despite legal troubles and a pending healthcare division spin-off, the company's restructuring plan is showing positive results with a 32% increase in free cash flow. While facing challenges, 3M's fundamentals are expected to improve, and the company is likely to maintain its Dividend King status. With its long-standing presence and strong financial position, 3M presents a compelling investment opportunity with a high dividend yield.

Zacks Investment Management Director Brian Mulberry recommends 3M as a "Good Buy" due to improved supply chain, potential margin savings, strong cash flow, and increased dividends, while advising against RTX Corp. due to foreign exchange headwinds, high interest rates, and Chinese sanctions on Taiwan impacting growth prospects in the industrial sector.

Despite 3M's historically high dividend yield and recent stock rally, potential investors should be cautious due to legal and regulatory challenges, plans to spin off its healthcare division, and concerns about its ability to innovate. The stock's price below $110 may not be as attractive as it seems, and conservative investors may want to wait for more clarity on the company's future before considering an investment.

Industrial giant 3M boasts a long history of increasing dividends annually, but despite its historically high dividend yield and recent stock rally, potential investors should be cautious. The company faces legal and regulatory challenges, including costly product liability lawsuits and environmental issues, and is planning to spin off its healthcare division. Questions about its ability to innovate further add to the uncertainty, making 3M a turnaround stock suitable for more aggressive investors, while conservative investors may want to wait for more clarity before considering an investment, regardless of the stock price.

3M's stock is down 9.5% after beating Q4 earnings but providing a weak 2024 outlook, reflecting ongoing operational issues and legal challenges. The company's restructuring efforts and healthcare spinoff may offer potential upside, but uncertainties persist, making it a cautious investment. The Motley Fool's Stock Advisor team did not include 3M in their top 10 stock picks, emphasizing the need for careful consideration before investing.