"Assessing 3M Co.'s Stock Performance Amid Market Fluctuations"

TL;DR Summary

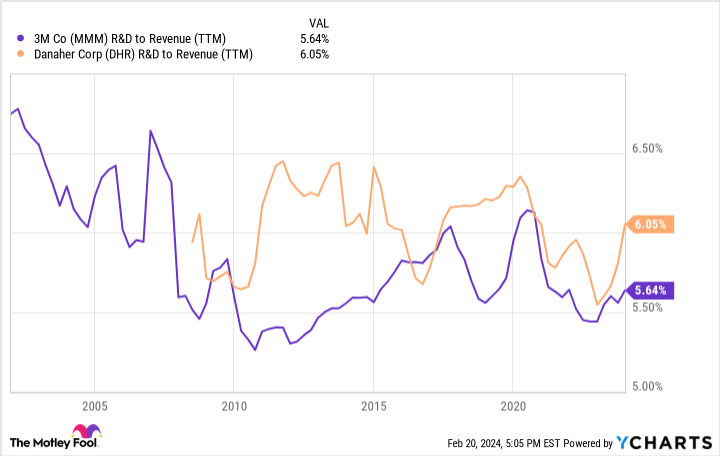

3M stock has plummeted 65% since 2018, raising questions about its potential as a buy-and-hold opportunity. The company's diversified business model and high-margin products make it an attractive long-term investment, but declining research and development spending and mounting debt levels pose challenges. 3M faces significant legal liabilities, including multi-billion dollar settlements, which may impact its financial position and ability to invest in innovation. While the stock still holds value, potential investors should consider the long-term horizon and management's ability to address these issues.

- After Falling 65%, Is 3M the Ultimate Buy-and-Hold Stock? Yahoo Finance

- 3M Co. stock underperforms Friday when compared to competitors despite daily gains MarketWatch

- Where Does Wall Street Think 3M Co (MMM) Stock Will Go? InvestorsObserver

- Why Is 3M (MMM) Down 1.6% Since Last Earnings Report? Yahoo Finance

- 3M Co. stock rises Thursday, still underperforms market MarketWatch

Reading Insights

Total Reads

0

Unique Readers

10

Time Saved

5 min

vs 6 min read

Condensed

93%

1,116 → 83 words

Want the full story? Read the original article

Read on Yahoo Finance