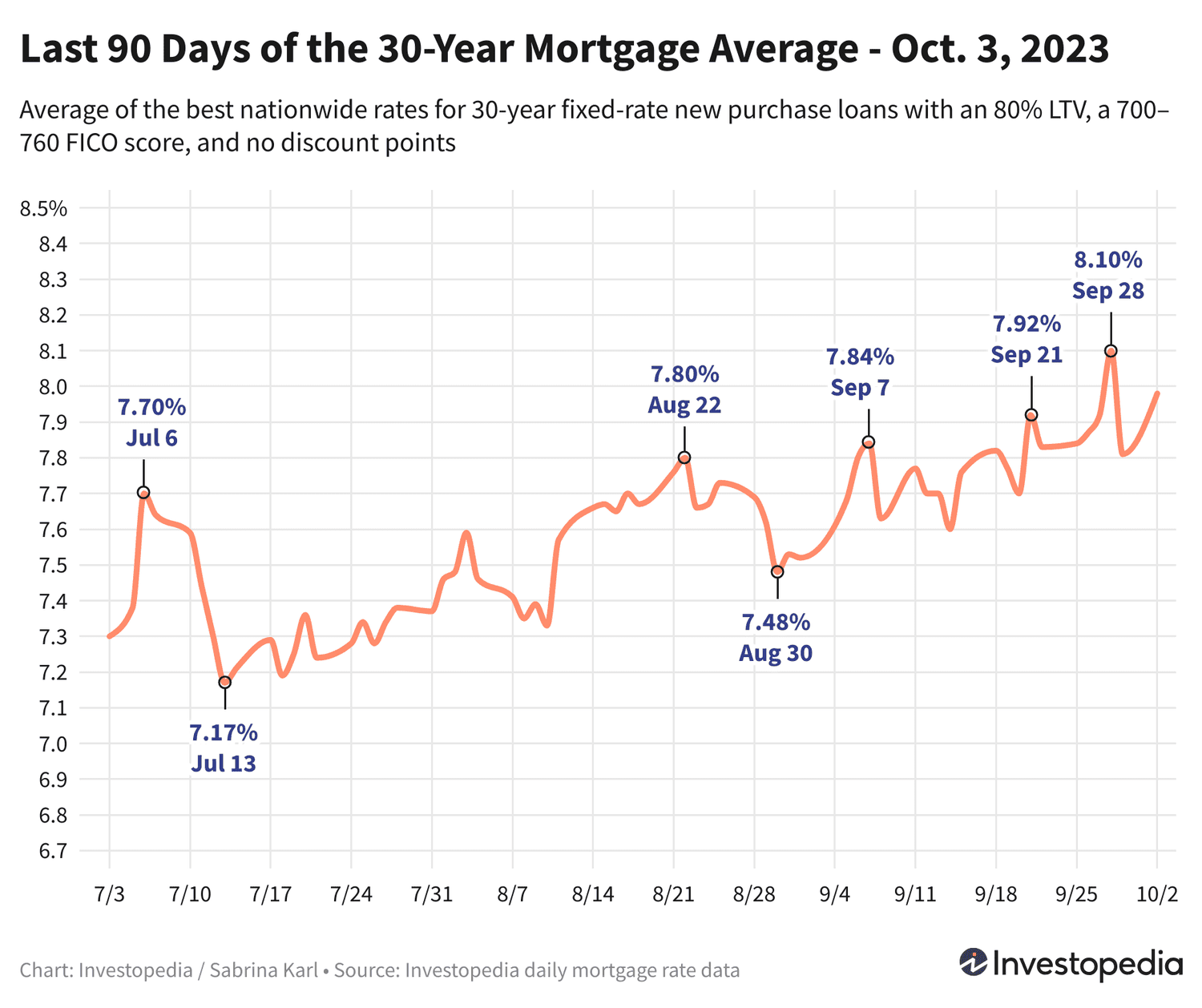

Surging Mortgage Rates Propel 15-Year Average to Record High

Mortgage rates, including 30-year and 15-year fixed-rate loans, have risen again after a significant drop last week. The 15-year average has reached a new historic high. The national averages for various loan types have also increased. It is advised to shop around and compare rates regularly when looking for a mortgage. The factors influencing mortgage rates include bond market movements, the Federal Reserve's monetary policy, and competition among lenders.