RBA faces close call on interest rate decision with outlier call for rate hike.

TL;DR Summary

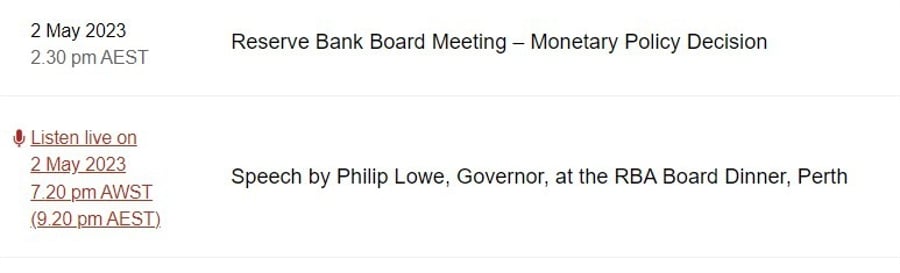

The Reserve Bank of Australia is set to meet on May 2, with the consensus expectation for a hold decision on interest rates. However, Commonwealth Bank of Australia is predicting a 25bp rate hike, with a 55% chance of an increase and a 45% probability of no change. The RBA is expected to retain its forecast for inflation to return to the top of the target band by mid-2025, despite Q1 23 CPI printing a little softer than the RBA’s implied profile from the February SMP. Governor Lowe will deliver a speech at the RBA Board dinner on May 2, and an updated set of economic forecasts will be published on May 6 in the May Statement on Monetary Policy.

- Preview: RBA monetary policy meeting today. Here's an outlier call for a 25bp rate hike. ForexLive

- Australia's central bank hikes rates by 25 basis points; Asia-Pacific markets mixed CNBC

- What to expect from tomorrow's interest rates decision | 9 News Australia 9 News Australia

- When is the RBA Interest Rate Decision and how could it affect AUD/USD? FXStreet

- Reserve Bank of Australia Set for Close Call-Rate Decision, AMP Says Bloomberg Television

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

1 min

vs 2 min read

Condensed

62%

316 → 120 words

Want the full story? Read the original article

Read on ForexLive