"US Inflation Outlook: Fed Faces Data Wild Card Ahead of Expected Pause"

TL;DR Summary

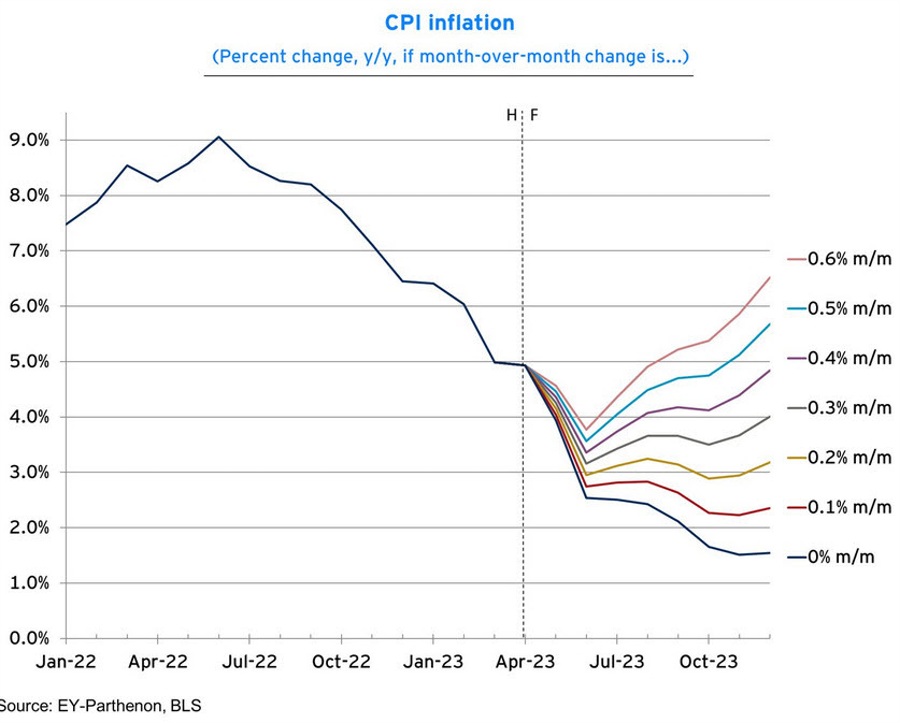

A chart from EY Parthenon's Greg Daco illustrates how monthly US inflation numbers migrate into year-over-year data. May and June will see lower year-over-year readings with gasoline prices down 30% y/y, but even with +0.2% readings, inflation will stay close to 3%, rather than falling to the Fed's target of 2%. The Fed will be looking for numbers in the +0.1-+0.2% range for many months before they signal preparedness to cut rates.

- This is the best chart for understanding how US inflation will unfold in the months ahead ForexLive

- Fed Day, Inflation Reading and More: What's on Deck Next Week The Wall Street Journal

- The Market Thinks the Fed Will Pause in June and Hike One Final Time In July Mish Talk

- Fed Faces Data Wild Card Ahead of Expected Pause TheStreet

- CPI Swaps Improving? Not as Significant as You Think | investing.com Investing.com

- View Full Coverage on Google News

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

1 min

vs 2 min read

Condensed

67%

215 → 72 words

Want the full story? Read the original article

Read on ForexLive