The Fed's Struggle to Control Inflation: A Status Update.

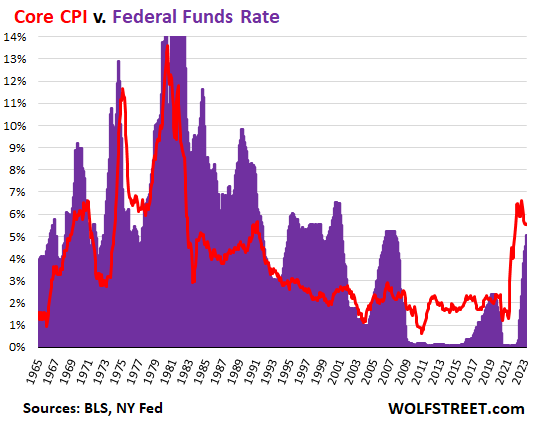

The Fed's policy rates have been raised by 500 basis points in a little over a year, but "core" CPI, which excludes the volatile food and energy components, has gotten stuck at around 5.5% to 5.7% for the fifth month in a row. Negative real policy rates are still a form of interest rate repression, and are still stimulative of the economy and of inflation. The crybabies on Wall Street are out there in force screaming about those unfair interest rates and clamoring for immediate rate cuts, like in June, to remove this incredible injustice of 5% short-term rates and even lower long-term Treasury yields (the 10-year Treasury yield is at 3.43%, LOL), when core CPI is 5.5%.

- The Fed's Interest Rates Are still Fueling Inflation rather than Dousing it, and People Getting Used to this Inflation WOLF STREET

- The Federal Reserve has tried to curb inflation. Here's how it is going CNN

- More Reasons for the Fed to Relent The American Prospect

- An unspoken truth, the Fed's goal of inflation at 2% is not easily attainable Kitco NEWS

- Is Inflation's Recent Decline At Risk Of Stalling? Seeking Alpha

- View Full Coverage on Google News

Reading Insights

0

5

3 min

vs 4 min read

81%

628 → 118 words

Want the full story? Read the original article

Read on WOLF STREET