Stocks Rise Amid Powell's Rate Cut Hopes and Market Uncertainty

TL;DR Summary

The S&P 500's rally is broadening as investors anticipate Federal Reserve rate cuts, leading to a significant rotation into small-cap stocks. The Russell 2000 outperformed the Nasdaq 100 by nearly 12 percentage points over four sessions, marking a historic shift. While this broadening is seen as positive, the rapid rise in small caps suggests potential overheating, prompting caution among investors. The overall market remains optimistic, buoyed by better-than-expected retail sales and hopes for economic resilience.

- S&P 500’s $18 Trillion Rally Is ‘Broadening Out’: Markets Wrap Yahoo Finance

- Stocks Buoyed by Small Caps as Big Tech Gets Hit: Markets Wrap Bloomberg

- The Stock Market Faces ‘Triple-Whammy Threat’ As S&P 500, Nasdaq, Dow Hover Near Record Highs Forbes

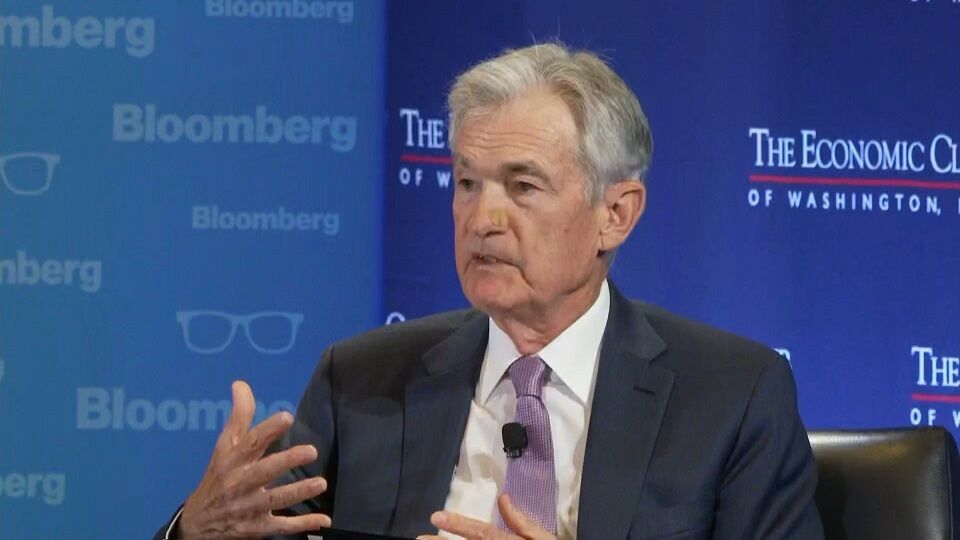

- Stocks rise with Treasury yields on pause, Powell boosts rate cut hopes Reuters.com

- Stock market today: Wall Street wavers ahead of congressional testimony from Powell Milford Mirror

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

8 min

vs 9 min read

Condensed

95%

1,653 → 75 words

Want the full story? Read the original article

Read on Yahoo Finance