Global Markets React to Banking Sector Stress and Fed Interest Rate Decision.

TL;DR Summary

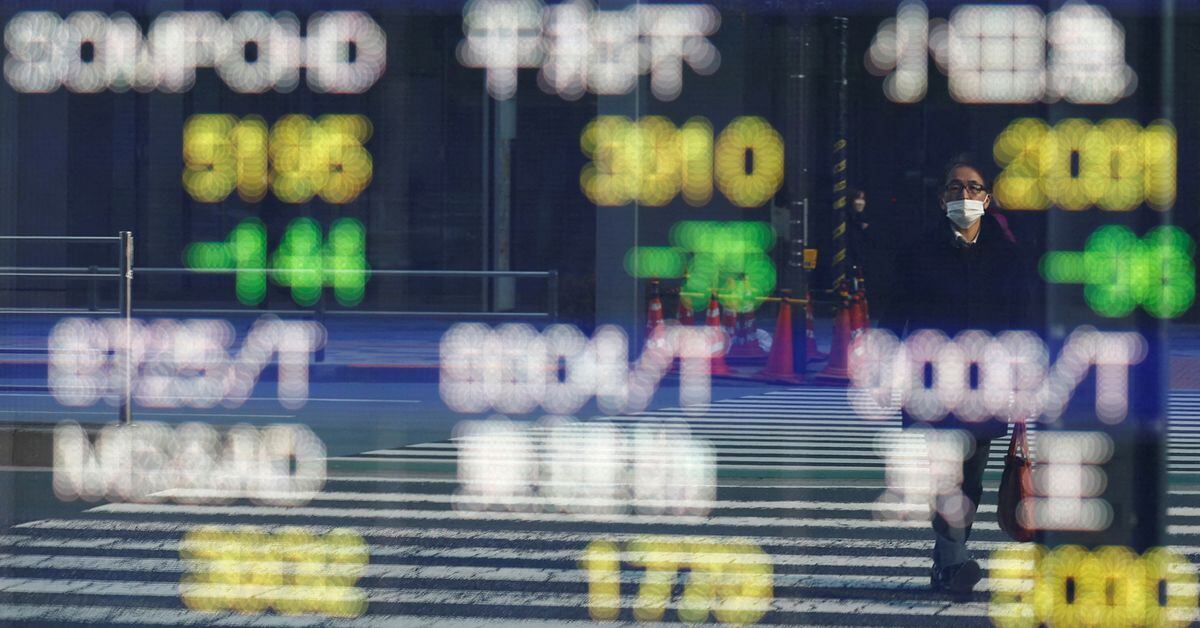

Asian shares struggled while US and European stock futures edged higher on hopes authorities were working to ring fence stress in the global banking system, even as the cost of insuring against default neared dangerous levels. The mood remained jittery after shares in Deutsche Bank fell 8.5% on Friday and the cost of insuring its bonds against the risk of default jumped sharply, along with the credit default swaps of many other banks. Depositors have been fleeing smaller banks for their larger cousins or to money market funds. Flows to money market funds have risen by more than $300 billion in the past month to a record atop $5.1 trillion.

Topics:business#asian-shares#credit-default-swaps#deutsche-bank#finance#global-banking-system#money-market-funds

- Asia shares skittish as banks face default stress Reuters

- Stock futures are up as Wall Street looks to build on winning week: Live updates CNBC

- Asian stocks rise ahead of Fed interest rate decision AP Archive

- Morning Bid: Weighing up the global banking crisis Reuters

- Asia markets trade mixed as banking sector stress lingers CNBC

Reading Insights

Total Reads

0

Unique Readers

0

Time Saved

2 min

vs 3 min read

Condensed

80%

548 → 110 words

Want the full story? Read the original article

Read on Reuters