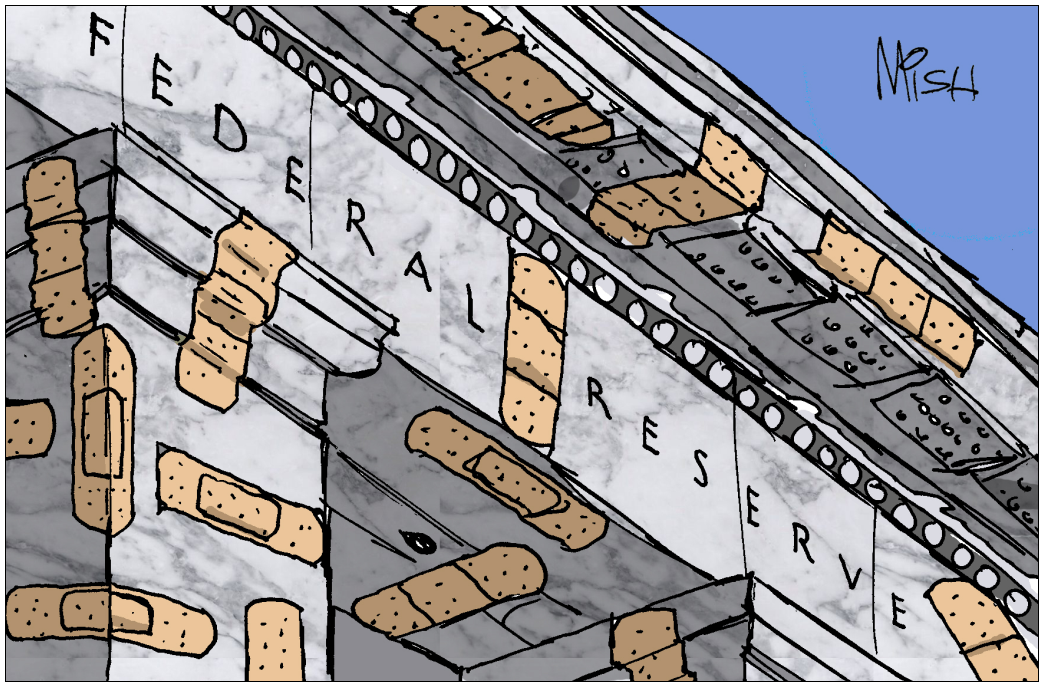

"Federal Reserve's Inaction Amid Banking Interest Rate Manipulation"

Online-centric banks like UFB, Capital One Financial, and CIT Bank are accused of deceiving customers by advertising competitive rates while paying longtime customers lower ones on high-yield savings accounts. The article suggests the need for a genuine savings bank that pays interest at the Fed funds rate minus a small cut to the bank taking the deposits, and criticizes the FDIC and Fed for not addressing the issue of banks speculating with interest rate bets on deposits. The author proposes the creation of a 100 percent safekeeping bank that only parks money at the Fed, in T-Bills, or in time-matched treasuries, and criticizes the Fed for refusing to grant FDIC to a bank operating on the safest possible policies while failing to monitor massive speculation on other banks.

Reading Insights

0

7

6 min

vs 7 min read

91%

1,379 → 128 words

Want the full story? Read the original article

Read on Mish Talk