"Citi Warns of Tech Stock Selloff Risk Due to Stretched Positioning"

TL;DR Summary

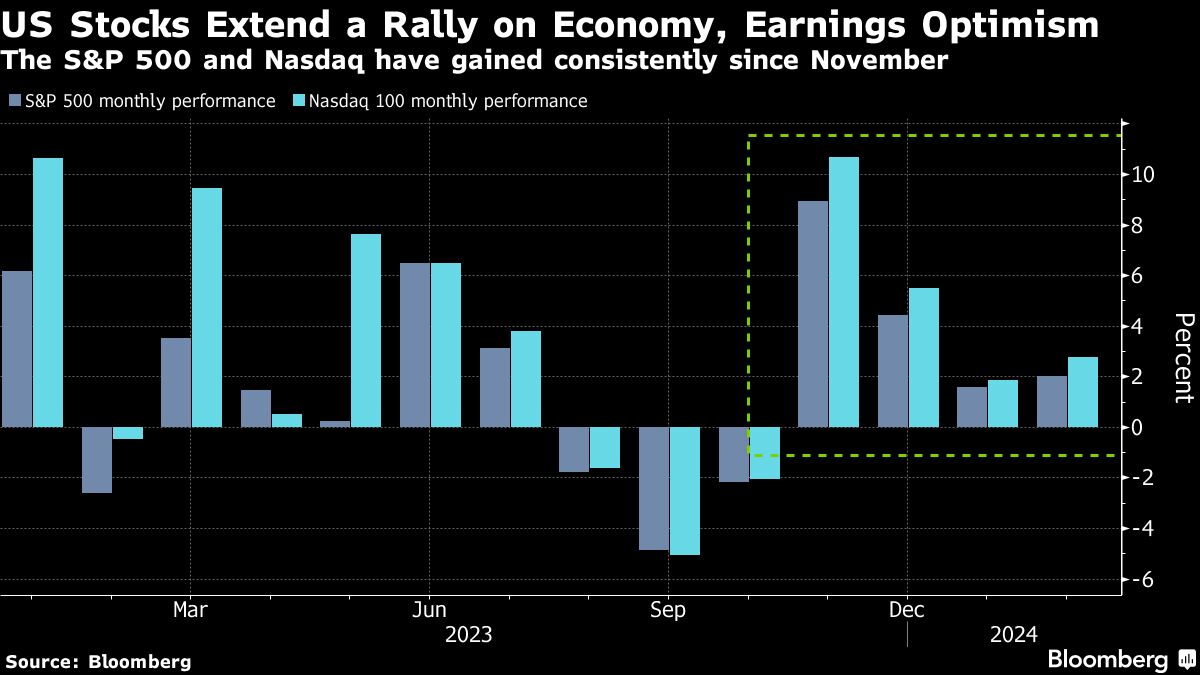

Citigroup Inc. strategists warn that bullish investor positioning in US technology stocks could lead to a wider market rout if a selloff occurs, with wagers on declines in tech-heavy Nasdaq 100 futures completely erased. Despite a rally in US stocks and record highs in the S&P 500, caution is growing due to signals that the Federal Reserve may not cut interest rates as early as March, leading to stalled bullish trends in S&P 500 futures.

Topics:business#citigroup-inc#federal-reserve#finance#investor-positioning#market-risk#us-technology-stocks

- Citi Says US Tech Stocks Face Risk of Big Selloff on Positioning Yahoo Finance

- Tech stocks vulnerable to sharp selloff with positioning stretched, Citi warns MarketWatch

- Citi's analysts say bullish stock flows have stalled By Investing.com Investing.com

- Tech stocks are vulnerable to sharp selloff due to stretched positioning, Citi warns MarketWatch

- ‘The cautionary signals are off the charts.’ Ominous warnings point to a market correction – particularly in tech MarketWatch

Reading Insights

Total Reads

0

Unique Readers

3

Time Saved

1 min

vs 2 min read

Condensed

72%

269 → 75 words

Want the full story? Read the original article

Read on Yahoo Finance