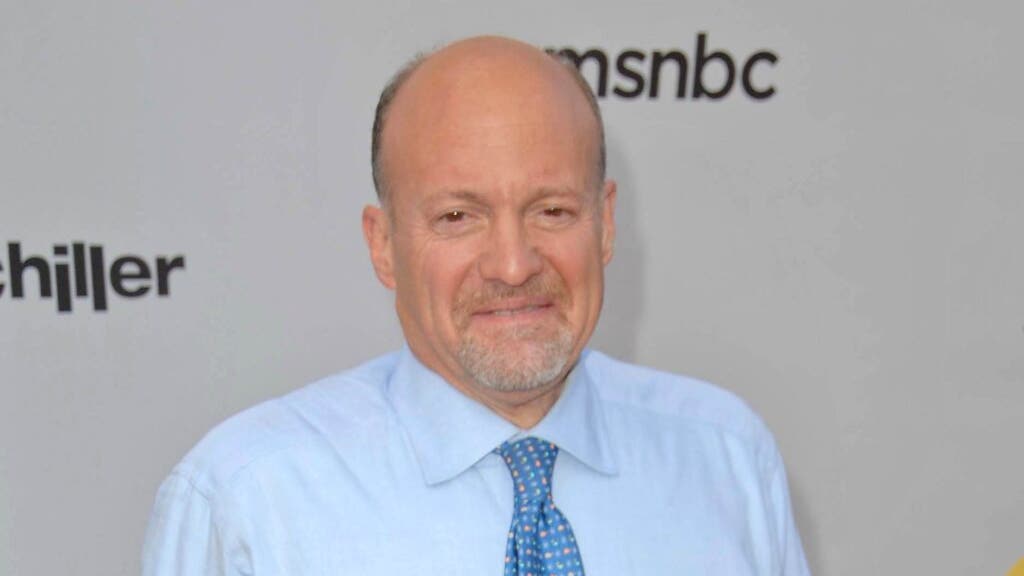

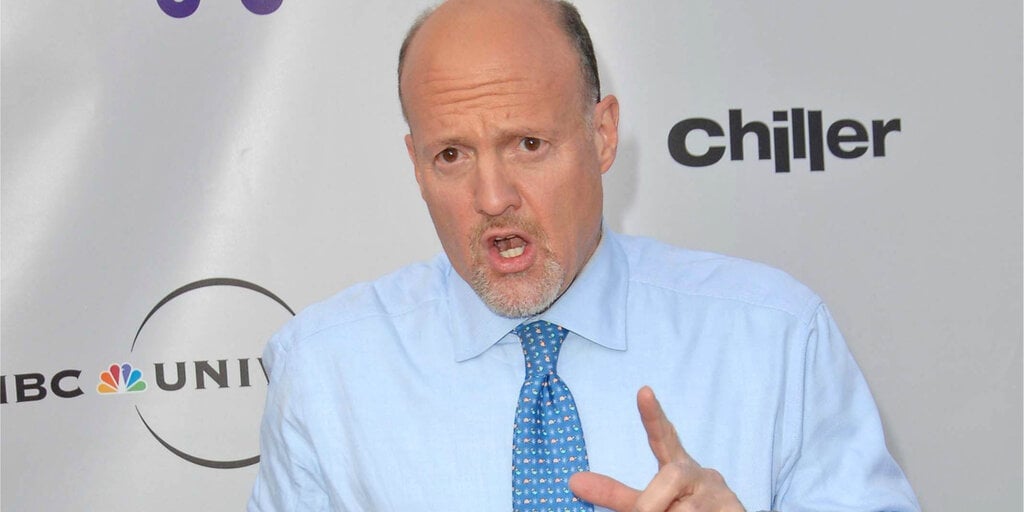

Jim Cramer's Market Insights: Navigating Recession Fears and Identifying Sustainable Investment Opportunities

Jim Cramer, a well-known investment pundit, has advised investors to sell shares of certain high-profile companies, including tech giants like Apple, Amazon, and NVIDIA, as the market shifts focus to "boring" stocks with high yields. He suggests that the market is rotating towards financial, healthcare, and small-cap stocks, which were previously overlooked. Cramer's recommendations are based on the performance trends of the S&P 500 and a broader money rotation in the market. The article evaluates the performance of the 12 stocks Cramer recommended selling, with a detailed look at their recent performance and Cramer's rationale for advising investors to sell them.