Russia's Oil Price Cap: A Successful Strategy?

TL;DR Summary

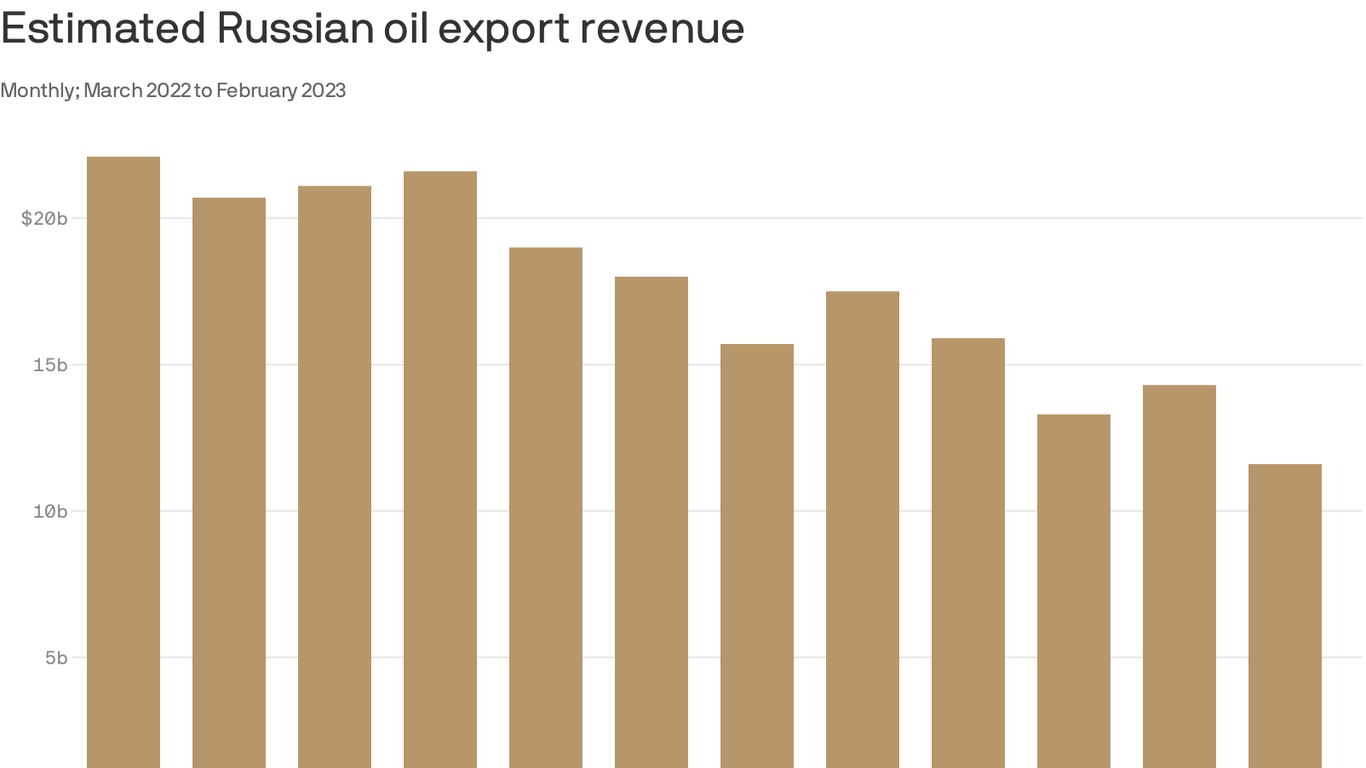

The price cap on Russian crude oil, imposed by the US Treasury Department and allies, seems to be working as Russia's oil and gas revenues plunged by 45% in Q1 2022 due to the costs of the war with Ukraine. The cap, in conjunction with other sanctions, has been successful at keeping Russian oil flowing while reducing the amount of money Russia reaps from its sale. However, it remains to be seen how well the cap would operate if energy demand from China fully bounced back.

- The price cap on Russian oil seems to be working Axios

- Russia's Flagship Oil Is Moving Ever Closer to $60-a-Barrel Price Cap gCaptain

- From shadow fleets for crude oil sales to new Asian trade routes: How Russia is evading Western sanctions EL PAÍS USA

- Keeping watch on the Russian oil price cap Financial Times

- Western curbs on Russian oil products redraw global shipping map ETEnergyWorld

Reading Insights

Total Reads

0

Unique Readers

1

Time Saved

3 min

vs 3 min read

Condensed

85%

587 → 86 words

Want the full story? Read the original article

Read on Axios