Rising BNPL Defaults Signal Growing Debt Crisis

TL;DR Summary

The rise of Buy Now, Pay Later (BNPL) programs in the US is leading to increased consumer debt and financial instability, especially among younger and lower-income individuals, while regulatory oversight remains weak, exacerbating economic inequality and consumer vulnerability.

- The Debt Economy Is Eating Everyone Alive Jacobin

- Fed, PYMNTS Reports Highlight How Financially Strained Consumers Use BNPL PYMNTS.com

- ‘Bellwether of Risks’: What ‘Buy Now, Pay Later’ Defaults Say About the Consumer The New York Times

- ‘Buy Now, Pay Later’ Crisis Brews Under Trump’s Watch The Daily Beast

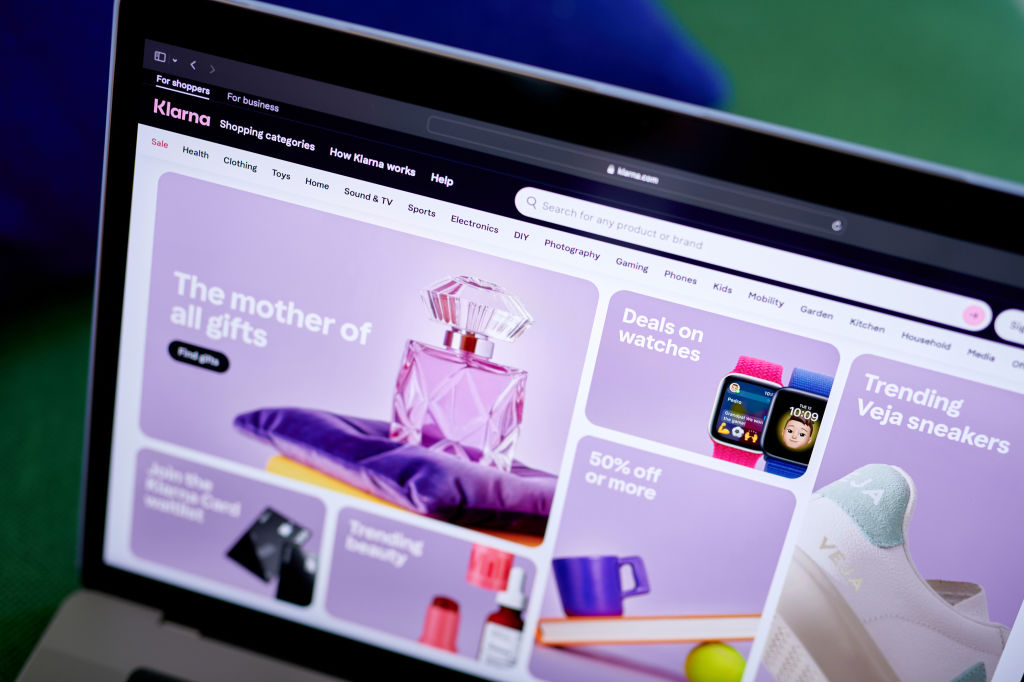

- Klarna IPO Update: Earnings Recap/Estimate Changes, 1Q25 Net Loss Widened to ~$101M Smartkarma

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

5 min

vs 6 min read

Condensed

96%

1,059 → 38 words

Want the full story? Read the original article

Read on Jacobin