"Former Trump advisor warns markets may be premature in anticipating rate hikes despite U.S. economy's return to normalcy"

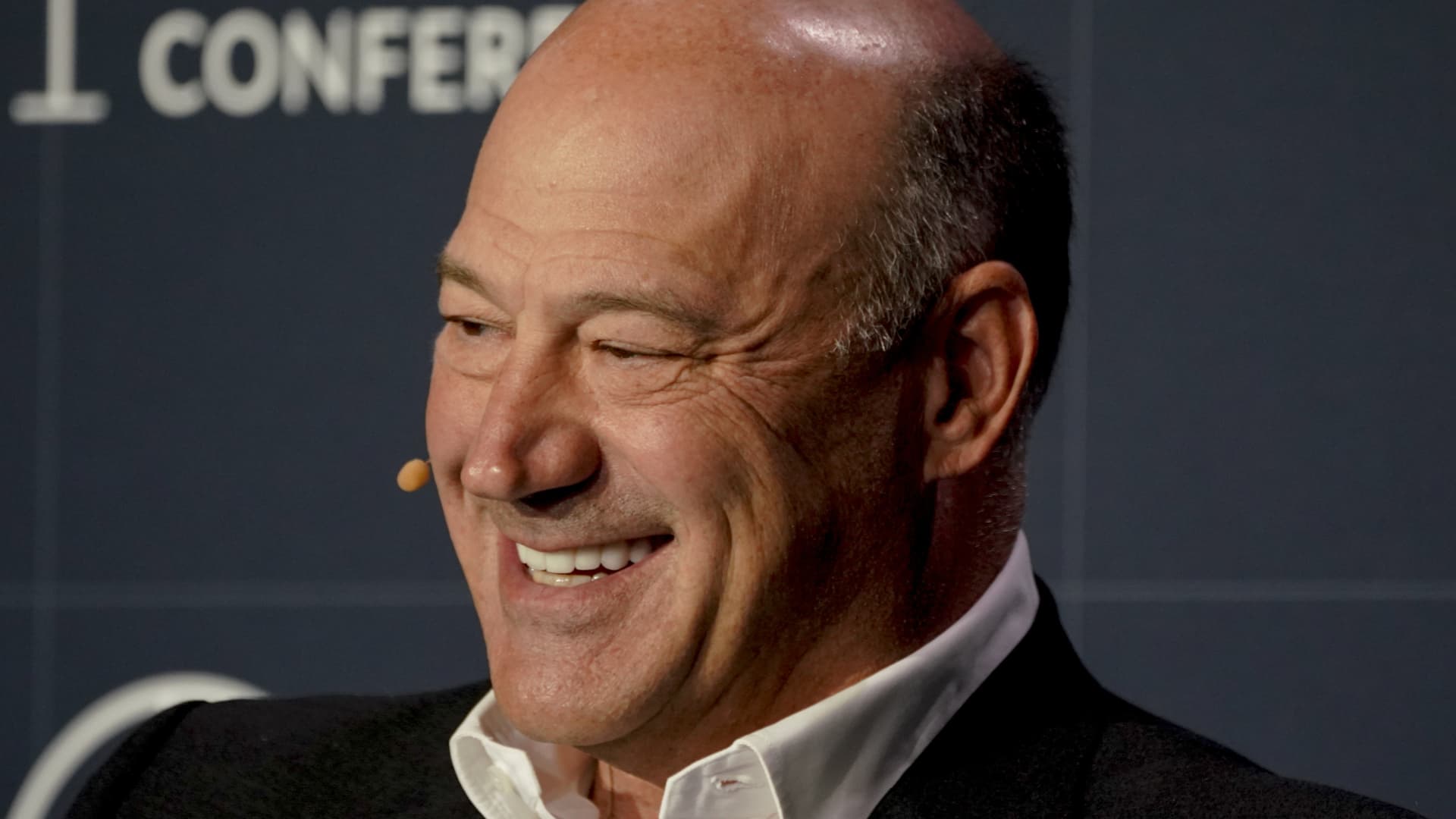

Former Trump advisor and IBM Vice Chairman Gary Cohn believes that the U.S. economy is "back to normal" for the first time in two decades. However, he suggests that the market may be jumping the gun on rate hikes, with expectations of a first rate reduction from the Federal Reserve in May 2024. Cohn predicts that the Fed will not start unwinding its position until at least the second half of next year, after other major central banks have already begun hiking rates. He also highlights the resilience of the U.S. economy despite rising interest rates and believes that the consumer and the broader economy are back to a normal state, although it has been over two decades since experiencing such conditions.

Reading Insights

0

0

2 min

vs 3 min read

79%

584 → 122 words

Want the full story? Read the original article

Read on CNBC