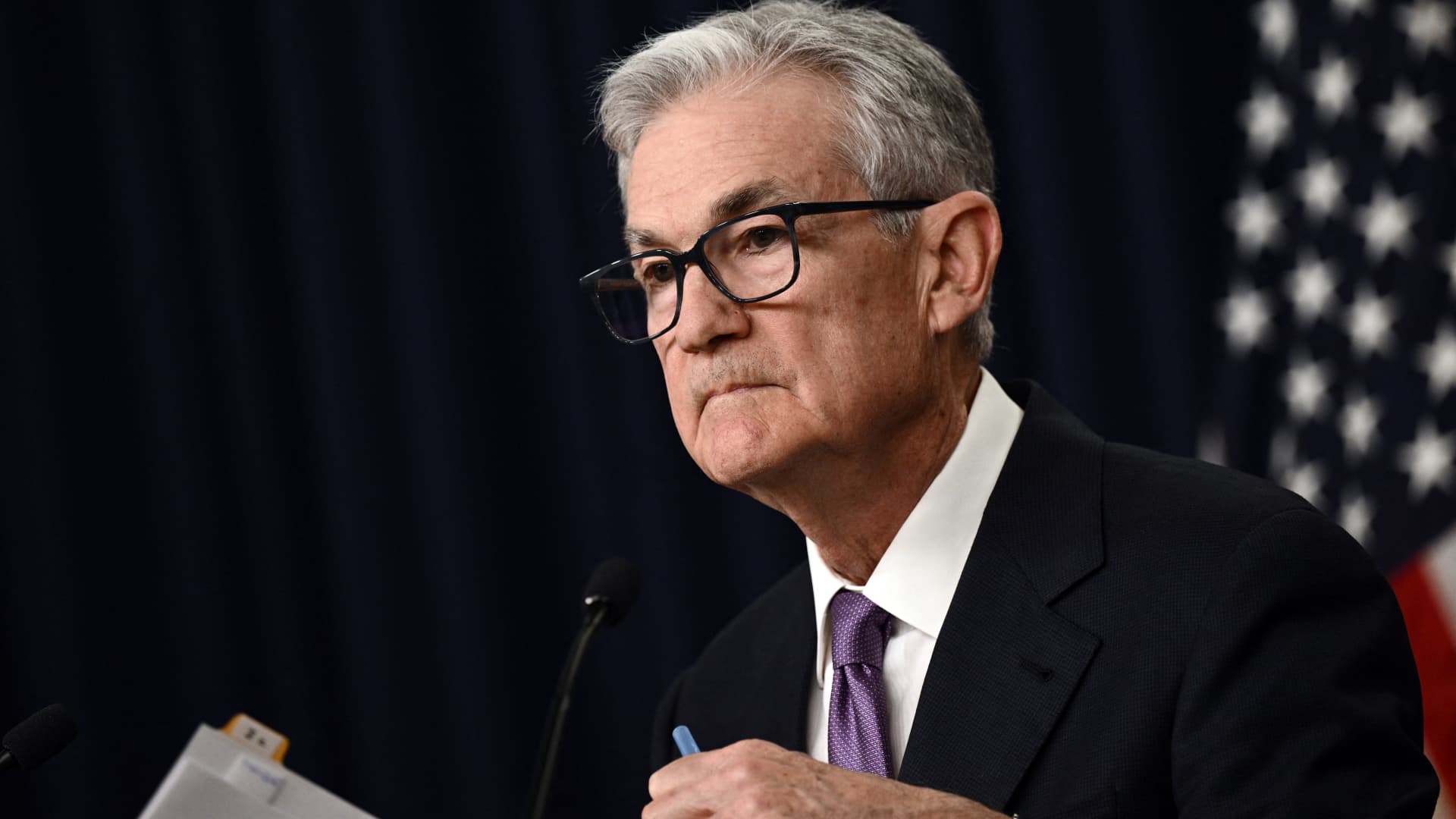

"Uncertain Path Ahead as Fed Signals Persistent High Rates with No Clear Timeline for Cuts"

Federal Reserve officials indicated in December that interest rate cuts are likely by the end of 2024, with the path highly uncertain and dependent on economic conditions. The Federal Open Market Committee (FOMC) maintained rates between 5.25% and 5.5% and projected three quarter-point cuts by 2024's end. Despite improvements in inflation and supply chain issues, there is an "unusually elevated degree of uncertainty" about future policy, with the possibility of maintaining or even raising rates if inflation persists. The Fed also discussed reducing its bond holdings, with plans to wind down the process when appropriate. Markets, however, are anticipating more aggressive rate cuts than the Fed officials projected.

- Fed officials in December saw rate cuts likely, but path highly uncertain, minutes show CNBC

- Fed officials said rates could remain high 'for some time' Financial Times

- Fed Minutes Suggest Rate Hikes Are Over, but Offer No Timetable on Cuts The Wall Street Journal

- Stocks Decline Again As Fed Won't Budge On Rate Cuts Forbes

- Stock Market News From Jan. 3, 2024: Dow Falls After Fed Minutes; Apple, Moderna, Verizon, and More Movers; Treasury Yields Fall; Bitcoin Price Falls Barron's

Reading Insights

1

2

3 min

vs 4 min read

83%

642 → 108 words

Want the full story? Read the original article

Read on CNBC