"Caution: US Consumer Spending Stalls as Economy Cools and Wages Rise"

TL;DR Summary

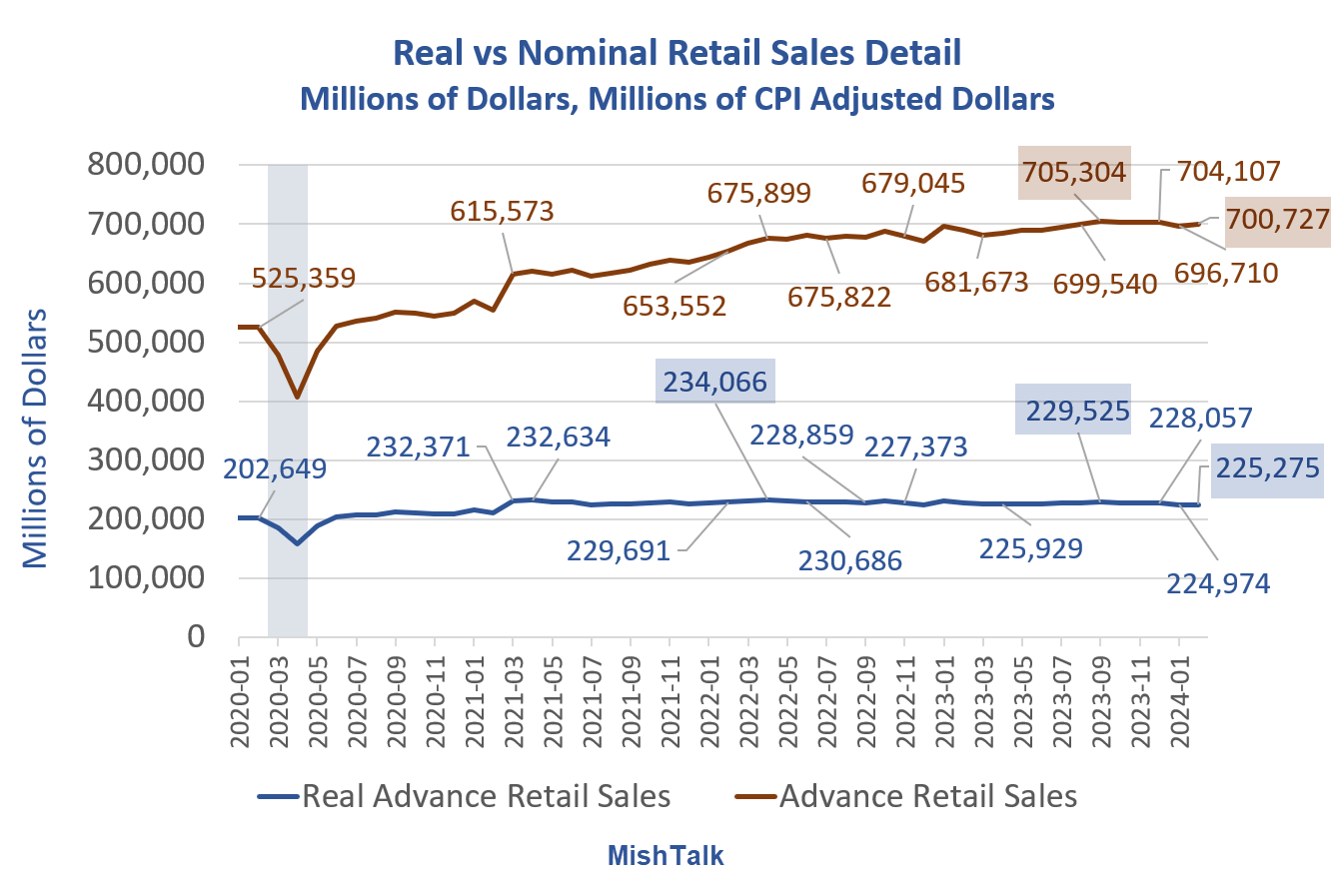

US consumer spending has shown signs of decline since October 2023, with real retail sales weakening despite nominal sales appearing strong. Economic stress is evident, particularly among younger age groups, as credit card and auto loan delinquencies soar to record highs. Homeownership rates also reflect struggles among Millennials and Zoomers. The popularity of "Buy Now, Pay Later" plans indicates consumer credit stress, while job market data reveals a weakening labor market. Additionally, inflation remains high, leading to concerns about stagflation as economic cracks in spending, employment, and delinquencies emerge.

- Has the US Consumer Finally Waved the White Flag on Spending? Mish Talk

- 'Underlying trends' in retail sales remain favorable, could delay first Fed cut: economist MarketWatch

- Americans are growing more cautious with their money Greater Baton Rouge Business Report

- US economy cooling in first quarter; inflation appears sticky Reuters

- Job market booms, wages rise but consumer spending appears to stall Axios

Reading Insights

Total Reads

0

Unique Readers

8

Time Saved

4 min

vs 5 min read

Condensed

90%

920 → 89 words

Want the full story? Read the original article

Read on Mish Talk