Cryptocurrencyfinance News

The latest cryptocurrencyfinance stories, summarized by AI

Featured Cryptocurrencyfinance Stories

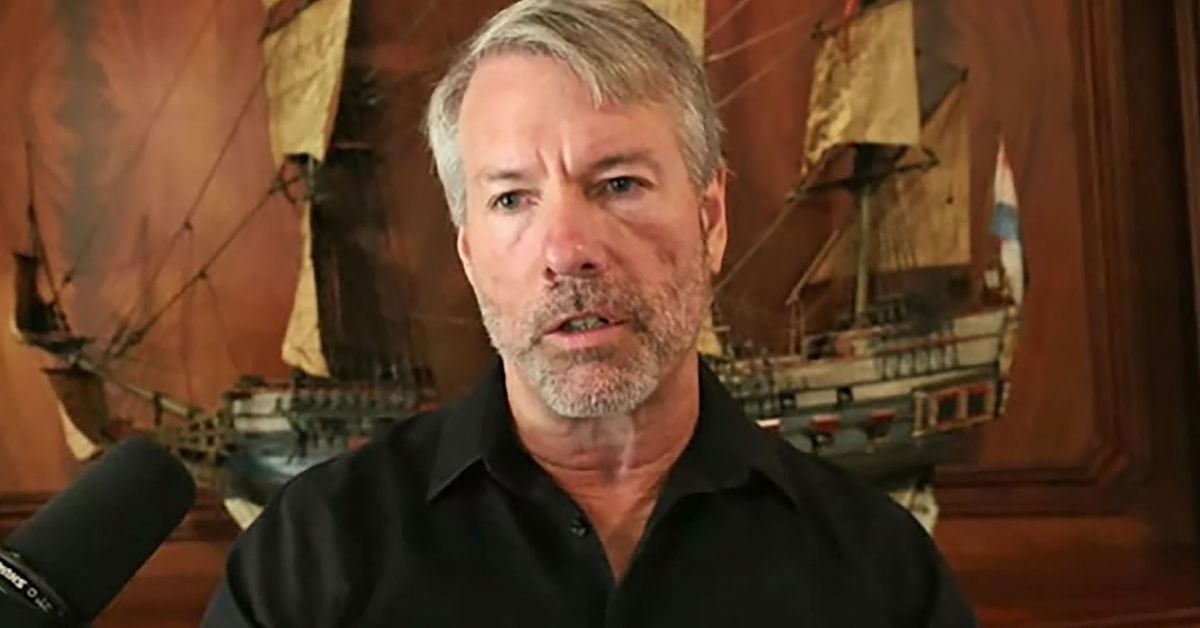

MicroStrategy's Aggressive Bitcoin Buying Spree Raises Concerns

MicroStrategy, a Bitcoin development company, has priced an upsized $525 million convertible debt offering, with the intention of using the proceeds to purchase more Bitcoin. This move comes as the company aims to add to its existing 205,000 bitcoin stack. The offering, which was originally planned at $500 million, was increased, and purchasers were granted an option to buy up to an additional $78.5 million of the paper, potentially bringing the total proceeds to around $600 million.

More Top Stories

"2024 Crypto Forecast: Expert Predictions and Bitcoin's Path Ahead"

David Gerard•2 years ago

More Cryptocurrencyfinance Stories

"UK Lawmakers Warn of Risks in Retail Digital Pound Rollout"

UK legislators are urging caution in the rollout of a retail digital pound, emphasizing the need for a careful examination of the potential benefits and drawbacks. The Treasury Select Committee recommends imposing lower initial limits on the value of retail digital pounds to mitigate the risk of bank runs during market instability. The committee also highlights the importance of protecting user privacy and limiting the use of data by the government or the Bank of England. Lawmakers stress the need for compelling evidence that the implementation of a retail digital pound would benefit the UK economy without incurring unmanageable costs or risks.

Binance CEO Pleads Guilty and Steps Down in $4.3 Billion Settlement

Binance CEO Changpeng Zhao has stepped down and pleaded guilty to breaking U.S. anti-money laundering laws as part of a $4.3 billion settlement, resolving a years-long probe into the world's largest crypto exchange. Zhao will personally pay $50 million, and the deal is described as one of the largest corporate penalties in U.S. history. Binance was found to have violated anti-money laundering and sanctions laws, failed to report suspicious transactions with terrorist groups, and never reported transactions involving child sexual abuse materials. Despite the serious violations, Zhao retains his stake in Binance, raising questions about the future of the exchange.

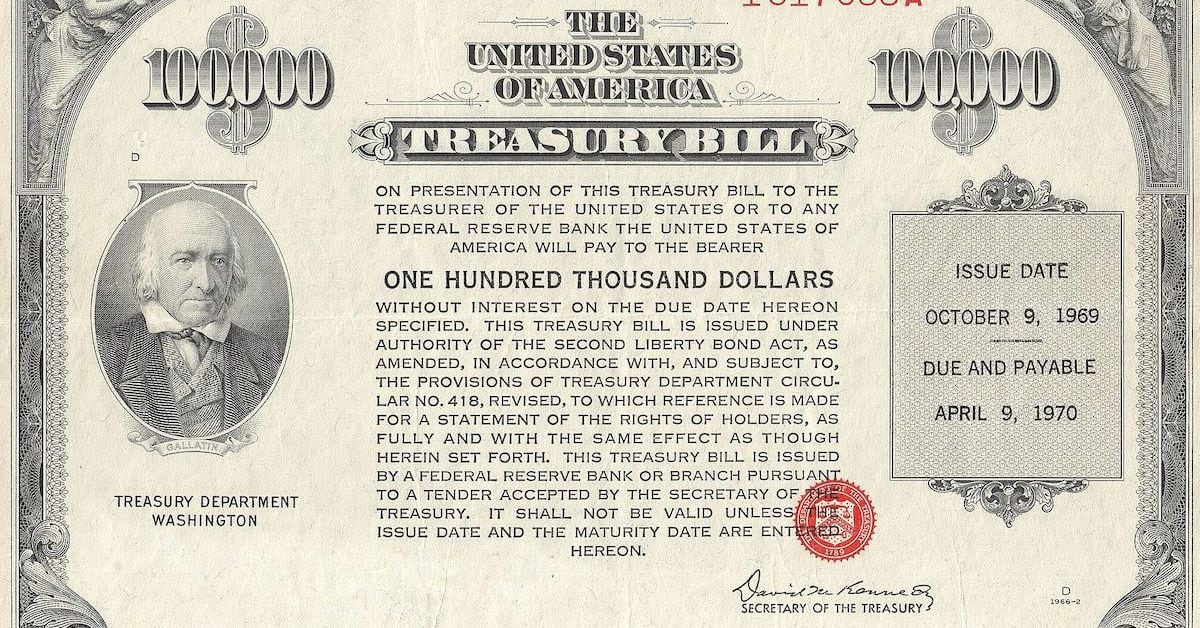

Introducing Midas: A Stablecoin Yielding from U.S. Treasuries

Midas, a new stablecoin project, plans to introduce its stUSD token backed by U.S. Treasuries to decentralized finance (DeFi) platforms like MakerDAO, Uniswap, and Aave. The project aims to tokenize traditional finance (TradFi) assets, such as Treasuries, to make them available in the DeFi ecosystem. Midas intends to purchase Treasuries through BlackRock and use Circle Internet Financial's USDC stablecoin as an on-ramp. The Midas stUSD token is 100% backed by U.S. Treasuries and complies with European Securities Regulation and Anti-Money Laundering law. The team includes Fabrice Grinda and Dennis Dinkelmeyer, both associated with Global Technology Acquisition Corp. The retail launch is expected early next year.

Sam Bankman-Fried's Trial: A Crypto King's Dramatic Dethroning and Sentencing

Sam Bankman-Fried, the former CEO of cryptocurrency exchange FTX, has been found guilty on all counts related to the collapse of the exchange, which resulted in the loss of around $1 billion in customer funds. The jury's verdict carries a potential prison sentence of over 100 years, with the final decision to be determined by Judge Lewis A. Kaplan. Bankman-Fried's ex-girlfriend and former CEO of FTX sister company Alameda, Caroline Ellison, testified against him, admitting to committing fraud under his instruction. Bankman-Fried's parents, who are law professors at Stanford University, reacted emotionally to the verdict. The trial also revealed that FTX had paid millions to celebrities like Tom Brady for promotional work, and jurors were shown commercials featuring Brady and comedian Larry David.

Sam Bankman-Fried's Fraught Testimony Unveiled in Trial Hearing

Sam Bankman-Fried, the CEO of FTX and founder of Alameda Research, testified in his fraud trial, revealing that he initially thought there was an 80% chance FTX would fail. He also admitted to knowing "basically nothing" about crypto before starting Alameda Research. Bankman-Fried denied defrauding anyone and acknowledged making mistakes. The trial continues, with Bankman-Fried's testimony being closely watched by the jury.

Sam Bankman-Fried to Take the Stand in FTX Fraud Trial

FTX founder Sam Bankman-Fried will testify in his own defense in the fraud trial against him, according to his attorney. This decision allows federal prosecutors to cross-examine him regarding the collapse of his crypto exchange. Bankman-Fried's defense team secured an adequate supply of his ADHD medication, which had been a concern. The defense will begin immediately after the government finishes its case, with three additional witnesses set to testify. Bankman-Fried is accused of fraud and money laundering related to the collapse of FTX, with the government presenting evidence of his alleged misuse of customer funds.

"Sam Bankman-Fried's Trial: Scandalous Testimony and Hair Controversy"

Jurors in the trial against Sam Bankman-Fried, the fallen crypto mogul and founder of FTX crypto exchange, have been presented with damning evidence by the prosecution, including testimony from a key witness, Caroline Ellison, the former CEO of Alameda Research and Bankman-Fried's ex-girlfriend. Ellison provided insight into the inner workings of Alameda and FTX, revealing dishonest financial practices and attempts to cover up losses. Bankman-Fried is facing seven counts of fraud and conspiracy, accused of stealing billions of dollars from FTX customers to cover losses at Alameda.

"Newton Native Caroline Ellison Reveals Inside Story of FTX Collapse at Sam Bankman-Fried Trial"

Caroline Ellison, former top executive of Sam Bankman-Fried's cryptocurrency hedge fund, Alameda Research, testified in court, blaming Bankman-Fried for corrupting her values and creating justifications for illegal actions. Ellison revealed that she repeatedly tapped into customer deposits at FTX, at Bankman-Fried's direction, to solve problems at the hedge fund or exchange. She also described a large bribe paid to Chinese officials to release frozen funds, as well as doctoring balance sheets to hide borrowing from FTX customers. Ellison pleaded guilty to fraud charges, while Bankman-Fried has pleaded not guilty.

FTX Founder Sam Bankman-Fried Accused of Directing Fraud and Crimes

Caroline Ellison, the former CEO of Sam Bankman-Fried's hedge fund, testified in court that Bankman-Fried instructed her and others to defraud FTX exchange customers by taking their money without their knowledge. Ellison revealed Bankman-Fried's obsession with rival Binance and his belief that he could become the US president. She admitted her involvement in fraud, conspiracy to commit fraud, and money laundering alongside Bankman-Fried. Ellison portrayed him as ambitious and the mastermind behind illicit activities, including siphoning funds from customers and investors. Bankman-Fried faces charges of fraud and conspiracy but maintains his innocence.

"Sam Bankman-Fried's Trial Unveils Surprising Evidence and Market Reactions"

The trial of Sam Bankman-Fried, co-founder of Alameda Research and FTX, is underway in New York. Prosecutors allege that Bankman-Fried "lied to the world" to increase his wealth and influence. Witnesses have testified about the collapse of FTX and the commingling of funds between FTX and Alameda. The trial has also revealed special privileges granted to Alameda on FTX, including an unlimited negative balance and exemption from liquidation. Bankman-Fried's defense argues that he made mistakes during a period of rapid growth and denies any theft.