Introducing Midas: A Stablecoin Yielding from U.S. Treasuries

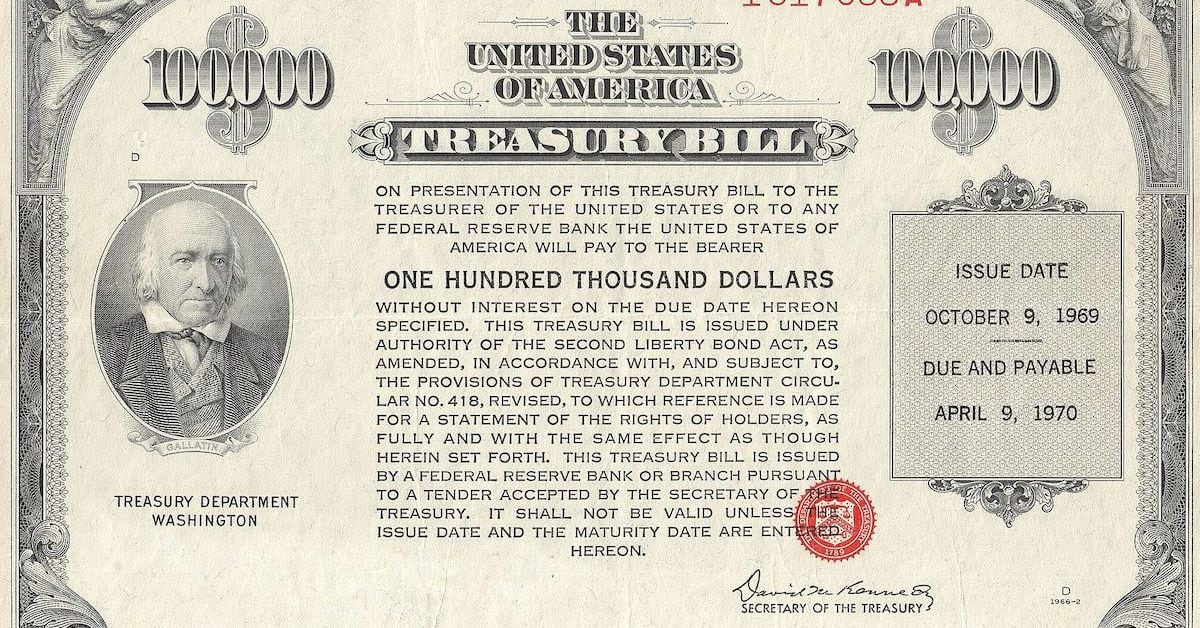

Midas, a new stablecoin project, plans to introduce its stUSD token backed by U.S. Treasuries to decentralized finance (DeFi) platforms like MakerDAO, Uniswap, and Aave. The project aims to tokenize traditional finance (TradFi) assets, such as Treasuries, to make them available in the DeFi ecosystem. Midas intends to purchase Treasuries through BlackRock and use Circle Internet Financial's USDC stablecoin as an on-ramp. The Midas stUSD token is 100% backed by U.S. Treasuries and complies with European Securities Regulation and Anti-Money Laundering law. The team includes Fabrice Grinda and Dennis Dinkelmeyer, both associated with Global Technology Acquisition Corp. The retail launch is expected early next year.

Reading Insights

0

2

1 min

vs 2 min read

68%

330 → 105 words

Want the full story? Read the original article

Read on CoinDesk