Cryptocurrency Market News

The latest cryptocurrency market stories, summarized by AI

Featured Cryptocurrency Market Stories

"Insights into Bitcoin Halving: Market Expectations and Miner Preparations"

The Bitcoin options market indicates a pre-halving price weakness and a bullish bias post-halving, with expectations for a price rally into six figures by December. Put options at strike prices of $61,000 and $60,000 have the highest open interest, suggesting a bearish sentiment leading up to the halving event, while calls at $70,000 and $80,000 are more popular for options expiring after the halving, indicating a bullish outlook. Analysts believe that the long-term outlook for Bitcoin depends more on macroeconomic factors and organic demand than the halving event.

More Top Stories

Bitcoin Volatility: Price Swings Amid Economic Data and Market Sentiment

CoinDesk•1 year ago

Bitcoin Slides to $66K Amid Rising Treasury Yields and Fed Rate Concerns

CoinDesk•1 year ago

More Cryptocurrency Market Stories

"Cryptocurrency Market Plunges Amidst Rate Hikes and ETF Volatility"

Bitcoin experienced a 6% drop in value over two days, reaching $65,150.00, due to rising Treasury yields and a stronger U.S. dollar. Ether also fell by 4.5% to $3,319.08. The 10-year U.S. Treasury yield hit its highest level of the year, and the dollar reached its highest level in almost five months. The drop in bitcoin price was possibly exacerbated by a large bitcoin holder transferring over 4,000 bitcoin to an exchange, signaling increased selling activity. Stocks tied to bitcoin's performance, including Coinbase and MicroStrategy, also saw declines. April may bring further volatility for crypto and related stocks, particularly mining stocks, as investors anticipate the bitcoin halving event in the second half of the month. Despite the recent drop, bitcoin is still up 53% for the year.

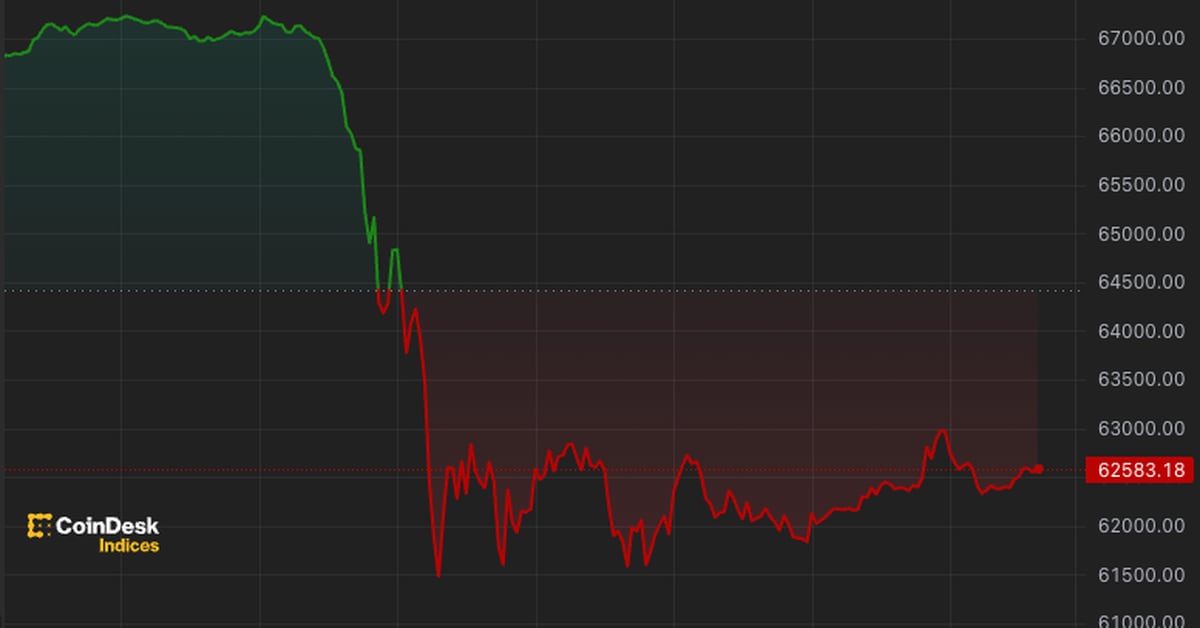

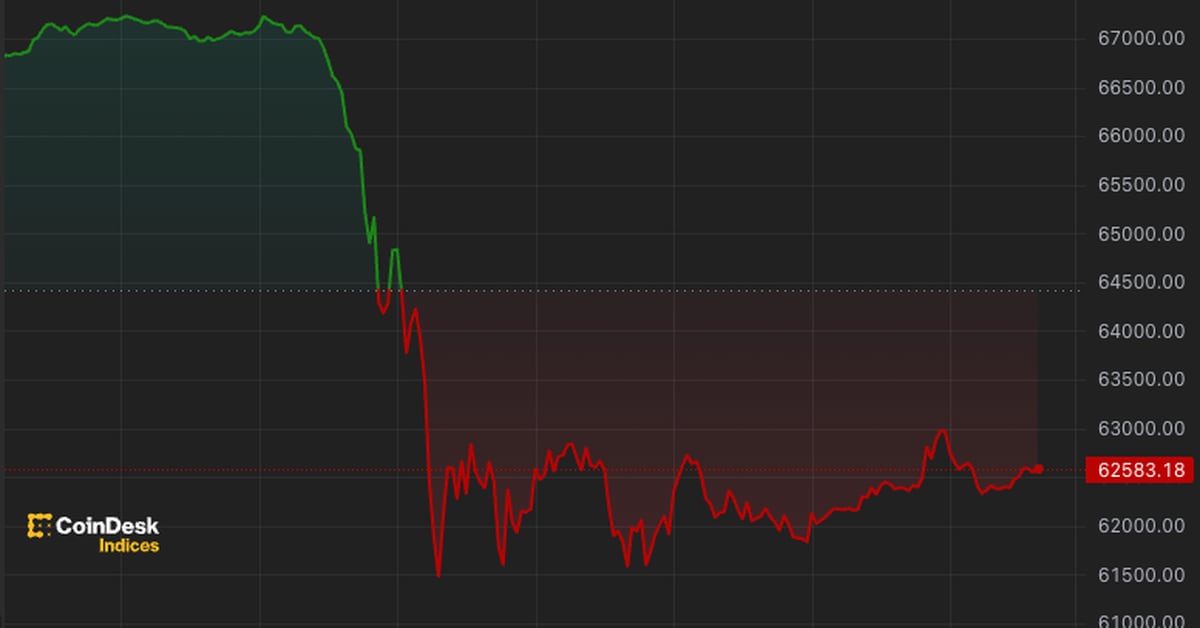

Bitcoin Price Plunges Below $67,000, Triggering $426 Million in Crypto Liquidations

Bitcoin's price fell below $67,000, leading to a 4.6% drop on the day and a 6% drop on the week, causing the wider crypto market to lose 5.2% of its total market cap. Over $426 million was liquidated in the past 24 hours, with Ethereum and other top cryptocurrencies also experiencing significant losses. The price dip coincides with the U.S. dollar index reaching a yearly high and heightened volatility ahead of April's Bitcoin halving, with some analysts suggesting a "crisis of faith" among traders. Despite this, a new report from Coinbase predicts a positive Q2 for the crypto market due to increased institutional interest following the approval of Bitcoin ETFs.

"Bitcoin and Altcoins Experience Major Sell-Off, $400M Liquidations Recorded"

Major cryptocurrencies, including bitcoin, ethereum, Cardano's ADA, and BNB Chain’s BNB, experienced significant losses, with over $400 million in bullish bets being liquidated. Solana's SOL dropped 7% and Dogecoin (DOGE) fell more than 8%, while Bitcoin Cash’s BCH fell 10% amid profit-taking after a recent rally. Analysts expect bitcoin to remain range-bound in the coming weeks as long-term investors sell off holdings, with resistance seen at the $71,000 level and caution in broader markets against riskier assets.

Cryptocurrency Market Volatility: Dogecoin Leads as Bitcoin and Ethereum Plunge

Bitcoin, Ethereum, and Bonk experienced significant declines today, with Bitcoin dropping 2.8%, Ethereum down 5.2%, and Bonk falling 9.4%. The market was influenced by factors such as the ISM factory index improvement, impacting investor sentiment. The decline is also attributed to the potential impact of interest rate changes on technology and high-growth stocks, as well as the uncertainty surrounding the approval of cryptocurrency exchange-traded funds (ETFs). The future of these cryptocurrencies remains uncertain, with speculation and fundamental value driving the market.

Bitcoin Holds Steady at $70K Amid Bull Run and Halving Anticipation

Bitcoin remains stable above $70,000 and Ether above $3600 ahead of the upcoming halving event, with options volatility high and perpetual futures funding rates inflated. Both cryptocurrencies showed relatively calm movement last week, but with the halving event approaching, implied volatility of front-month options remains elevated. Funding rates are also inflated, and global open interest for BTC and ETH perpetual futures has hit $35 billion, indicating the potential for a return to a more volatile market regime. Positive inflows into bitcoin ETFs have contributed to bitcoin's rally before the long weekend.

"Spot Bitcoin ETF Flows Drive Crypto Market Amid Record GBTC Outflows"

The cryptocurrency market is closely monitoring the outflows from spot bitcoin exchange-traded funds (ETFs) rather than focusing on fundamentals, as the recently approved products saw their first week of net outflows in two months. Coinbase reported that the Grayscale Bitcoin Trust (GBTC) experienced $1.83 billion in outflows over four days, with potential selling pressure coming from the bankruptcy estate of Genesis Global. Despite the uncertainty surrounding the recent outflows, Coinbase suggested that the majority of creditor payments being made in crypto rather than cash should eventually have a net neutral effect on bitcoin performance.

"Crypto Rally: Bitcoin and Ether Surge as NYC Celebrates All-Time Highs"

Bitcoin and Ether started the week in the green as the global easing cycle began, with the Swiss National Bank cutting rates. The market reacted positively to BlackRock's move into asset tokenization and the central bank easing cycle. Bitcoin traded at $67,300, up 4.9%, and Ether traded 4.7% higher above $3,400. The CoinDesk 20 was up around 5%. Short positions in Bitcoin and Ether saw significant losses, with over $100 million in leveraged futures positions liquidated in the last 24 hours. The onset of the global easing cycle and slowing selling pressure from the Grayscale Bitcoin Trust contributed to the bullish market sentiment.

Bitcoin and Ethereum Dip as Crypto Market Sees Red Ahead of Halving

The cryptocurrency market experienced a downturn with Bitcoin, Ethereum, and Solana all seeing declines ahead of the Bitcoin halving, potentially indicating volatility as traders assess the event's impact. Bitcoin fell over 4% to around $63,400, while Ethereum dropped almost 6% to approximately $3,320 amid anticipation for SEC decisions on ETF approvals and investigations. Solana, previously buoyed by meme coin trading, also dipped by 8% to around $171, following congestion issues and a cooling meme coin frenzy.

"Crypto Market Plunge: Bitcoin and Ethereum Prices Tumble, Investors Brace for Volatility"

The cryptocurrency market has seen a significant sell-off, with bitcoin dropping below $61,000 after hitting an all-time high last week. The sell-off has also affected other digital assets like ether and Solana, with the total market value shedding $400 billion. Factors contributing to the decline include profit-taking, outflows from bitcoin ETFs, and concerns about high fees. Analysts suggest that if bitcoin falls below $60,000, it could weaken further, potentially testing the $50,000 to $52,000 level.

Bitcoin Flash Crash: From $73,000 to $8,900 - What Happened?

Bitcoin experienced a sudden crash to $8,900 on BitMEX, causing over $440 million in liquidations for futures traders, with Binance recording the most at $212 million, while Grayscale's GBTC ETF saw record high outflows. Binance is now requiring enhanced KYC tests for its prime brokers to ensure compliance with U.S. regulations after settling a case for $4.3 billion. Meanwhile, the chart indicates a surge in buying pressure for Solana (SOL) compared to a downtrend in Ethereum (ETH).