"Sky-High Hotel Prices as Eclipse Tourists Book Out Syracuse"

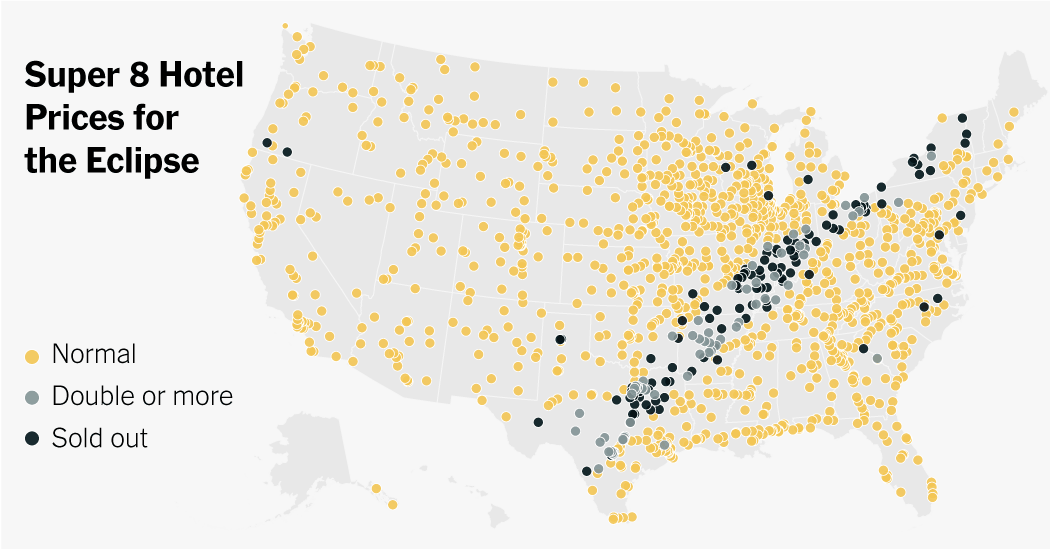

The upcoming solar eclipse is causing a surge in hotel prices, with some Super 8 locations along the eclipse's path charging up to ten times their usual rates. The parent company, Wyndham Hotels & Resorts, stated that each Super 8 franchise sets its own prices using revenue management software. Even upscale hotels in major cities are experiencing price spikes, with some doubling or tripling their rates for the eclipse period.