Walgreens Becomes Private Company Under Sycamore Ownership

Walgreens Boots Alliance has completed its transition to a private company following a merger or acquisition, marking a significant change in its corporate structure.

All articles tagged with #walgreens boots alliance

Walgreens Boots Alliance has completed its transition to a private company following a merger or acquisition, marking a significant change in its corporate structure.

Two high-yield dividend stocks, Annaly Capital Management and Walgreens Boots Alliance, are currently undervalued and present attractive opportunities for income seekers. Annaly, a mortgage REIT, offers a 13.2% yield and could benefit from a stabilizing interest rate environment. Walgreens, yielding 6.17%, is undergoing a strategic turnaround under new leadership with a focus on healthcare services and cost-cutting measures.

The article highlights two ultra-high-yield dividend stocks, Annaly Capital Management and Walgreens Boots Alliance, which are currently undervalued and present attractive buying opportunities for income seekers. Annaly Capital Management, a mortgage REIT, offers a 13.2% yield and could benefit from potential interest rate stabilization. Walgreens Boots Alliance, yielding 6.17%, is undergoing a strategic turnaround under new leadership, focusing on healthcare services and cost-cutting measures.

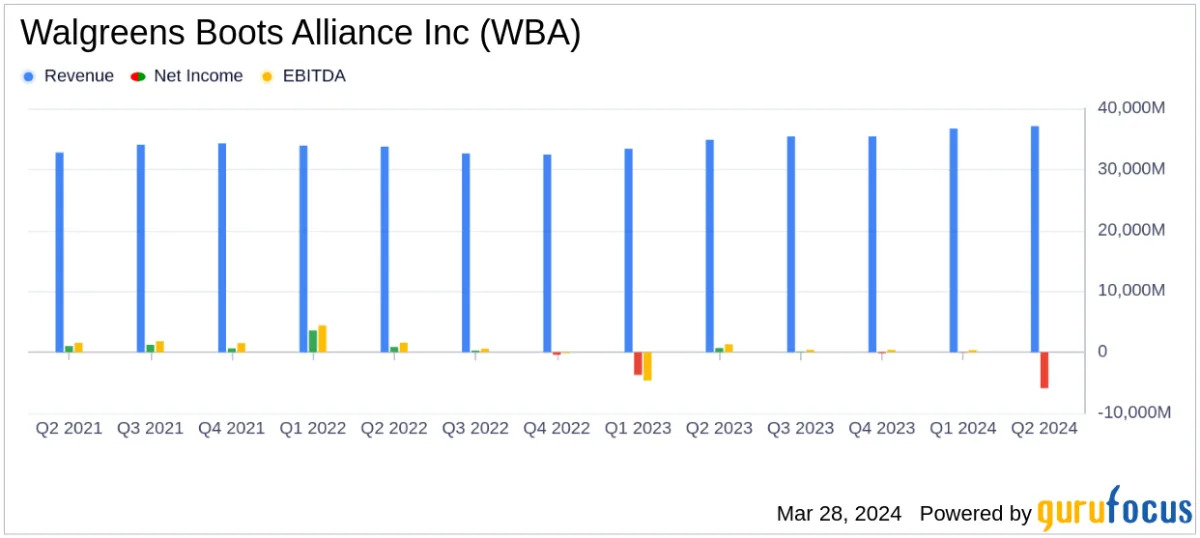

Walgreens Boots Alliance reported second quarter revenue of $37.05 billion, beating expectations, but also a net loss of $6 billion due to the decline in the value of its investment in VillageMD. The company cited a challenging retail environment and narrowed its 2024 earnings outlook. The new leadership is focusing on scaling back and rightsizing the company, with a shift towards a back-to-basics focus on pharmacy.

Walgreens Boots Alliance Inc reported a 6.3% increase in Q2 sales to $37.1 billion, but also a net loss of $5.9 billion due to non-cash impairment charges related to VillageMD goodwill. Despite the loss, the adjusted EPS of $1.20 exceeded estimates, and the U.S. Healthcare segment achieved positive adjusted EBITDA for the first time. The company faces challenges in the retail environment but is focusing on cost-saving initiatives and strategic shifts towards healthcare services for potential growth.

Walgreens Boots Alliance reported its fiscal 2024 second quarter results, with a 6.3% increase in sales to $37.1 billion, but also a $5.8 billion non-cash impairment charge related to VillageMD goodwill, resulting in a $6.85 loss per share. The company narrowed its full-year adjusted EPS guidance range to $3.20 to $3.35 due to a challenging retail environment in the U.S. and other factors. The U.S. Healthcare segment achieved adjusted EBITDA profitability, and the company remains focused on customer engagement and value amidst ongoing operational challenges.

Several stocks are making significant moves in premarket trading, including Walgreens Boots Alliance, Estee Lauder, and RH.

The Dow Jones Industrial Average will undergo its 52nd change on Monday, with Walgreens Boots Alliance being replaced by Amazon, and Walmart enacting a 3-for-1 stock split. The removal of Walgreens and addition of Amazon reflect the Dow's need for outperforming companies, while Walmart's split aims to make shares more affordable for employees. These changes will also impact the Dow's divisor, reshaping the index's composition and influence.

Walgreens Boots Alliance (WBA) stock closed at $20.79, with a 4.26% increase, and has a dividend yield of 9.21%. To earn $500 per month from WBA dividends, an investment of $65,147 is needed, while a $100 monthly income requires an investment of $13,029. It's important to note that dividend yields can change over time due to stock price fluctuations and changes in dividend policies.

Walgreens Boots Alliance is reportedly exploring options to offload its UK drugstore chain Boots, including a potential initial public offering (IPO) in London. The company is holding early talks about separating Boots, which could be valued at around £7 billion ($8.8 billion) in a deal. Walgreens had previously abandoned a sale process for Boots in 2022 due to valuation concerns. The potential divestment of Boots would provide a boost to the London stock market, which has seen a decline in IPO fundraising this year. Any process is expected to start next year at the earliest.

Shares of Walgreens Boots Alliance jumped 8.8% as investors speculate that the stock has hit bottom. The company has faced challenges in the pharmacy industry, including the bankruptcy of Rite Aid, and has reported a $3.1 billion loss in the past year. While the stock may be experiencing a short squeeze, there are concerns about the company's fundamental performance and ability to turn around its business.

Walgreens Boots Alliance's international unit, Boots, is transferring its $6 billion pension plan to UK-based financial services company Legal & General, a move that could potentially pave the way for a sale of the pharmacy chain. The buy-in deal insures all 53,000 members in the Boots Pension Scheme and eliminates a major hurdle in previous negotiations for a sale. Walgreens had attempted to sell Boots in 2021 but abandoned the plans due to lack of good offers. Transferring the pension plan provides clarity on Boots' financial trajectory and increases the likelihood of a successful sale.

Walgreens Boots Alliance reported its fiscal year 2023 earnings, with a loss per share of $3.57 compared to earnings per share of $5.01 in the previous year. The company's fourth-quarter sales increased 9.2% year-over-year to $35.4 billion. Walgreens Boots Alliance appointed Tim Wentworth as its new CEO and announced planned cost reductions of at least $1 billion. The company expects to see the impact of these actions in fiscal 2024.

The U.S. Food and Drug Administration (FDA) has issued warnings to eight companies, including CVS Health Corp and Walgreens Boots Alliance, for manufacturing or marketing unapproved eye products. These products are illegally marketed to treat conditions such as conjunctivitis, cataract, and glaucoma, posing an increased risk to users. Some of the products contain silver, which can cause permanent discoloration of the skin and eye tissues. CVS has already halted the sale of its "Pink Eye Relief Eye Drops" and is offering full refunds to customers. The FDA has given the companies 15 days to respond and correct the violations, warning that failure to do so may result in legal action.

Investing in dividend stocks can be a successful strategy for generating income, and the Dow Jones Industrial Average offers opportunities for high-yield dividends. Two ultra-high-yield Dow stocks that provide super-safe annual dividend income are Verizon Communications, with an 8.09% yield, and Walgreens Boots Alliance, with a 6.49% yield. Despite recent challenges, both companies have strong fundamentals and growth catalysts that make their dividends reliable for income seekers. Verizon benefits from the 5G revolution and its resurgent broadband segment, while Walgreens is implementing growth initiatives in healthcare services and technology.