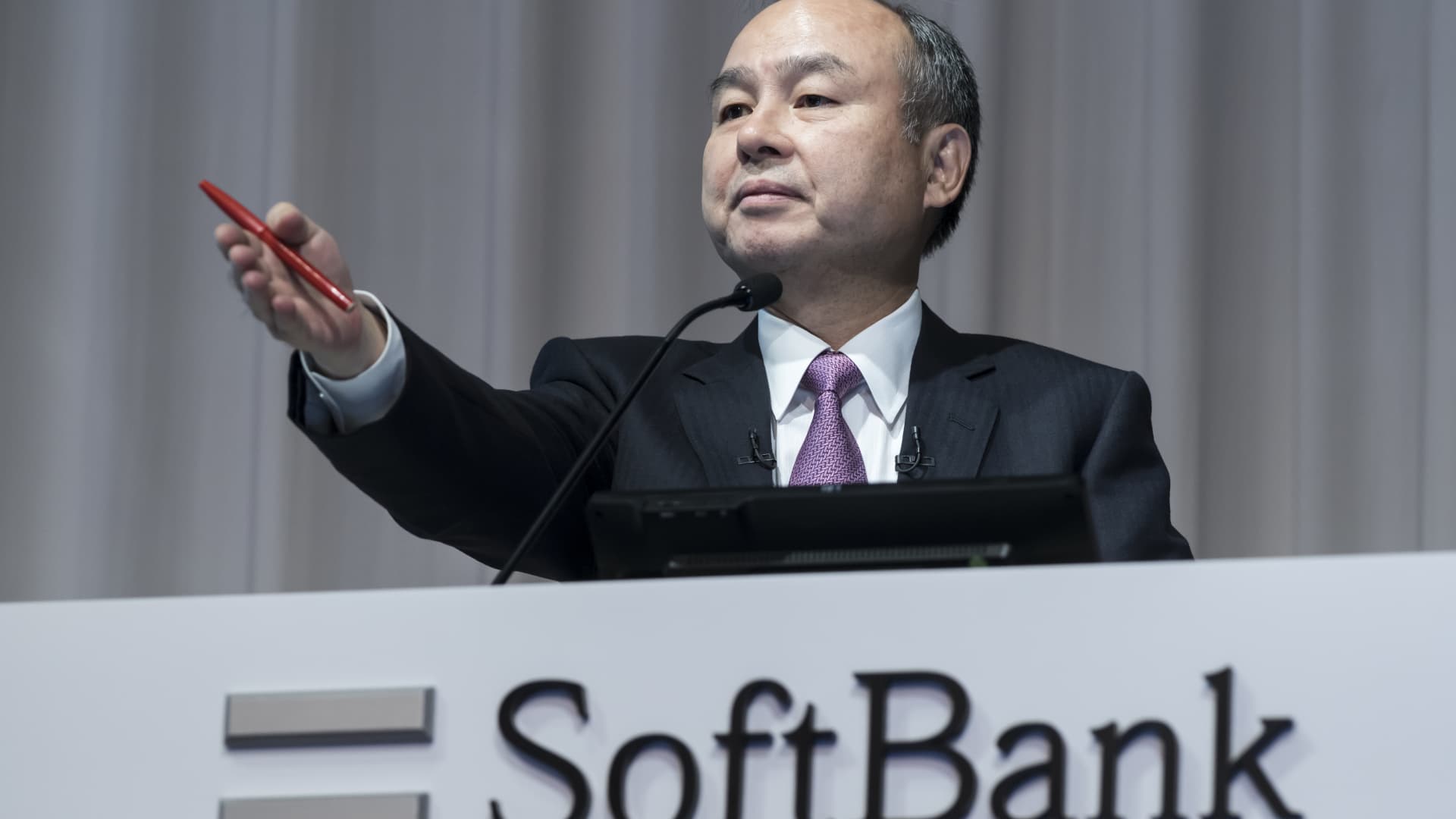

SoftBank Returns to Profit with Vision Fund Gains and Indian IPO Boost

SoftBank Group Corp. reported a significant gain of 608.5 billion yen ($3.96 billion) from its Vision Fund tech investment arm in the fiscal second quarter, driven by valuation increases in companies like Coupang and Didi Global. Despite a net loss in Vision Fund 2, the company benefited from the successful listing of Arm Holdings and investment gains in Alibaba and T-Mobile. SoftBank is repositioning itself in the AI sector, with plans to invest in OpenAI, while facing pressure from activist investor Elliott Management for share buybacks. The Japanese market remains volatile amid economic transitions.