Taiwan, Chips, and Apple: A Geopolitical Crunch for Tech Giants

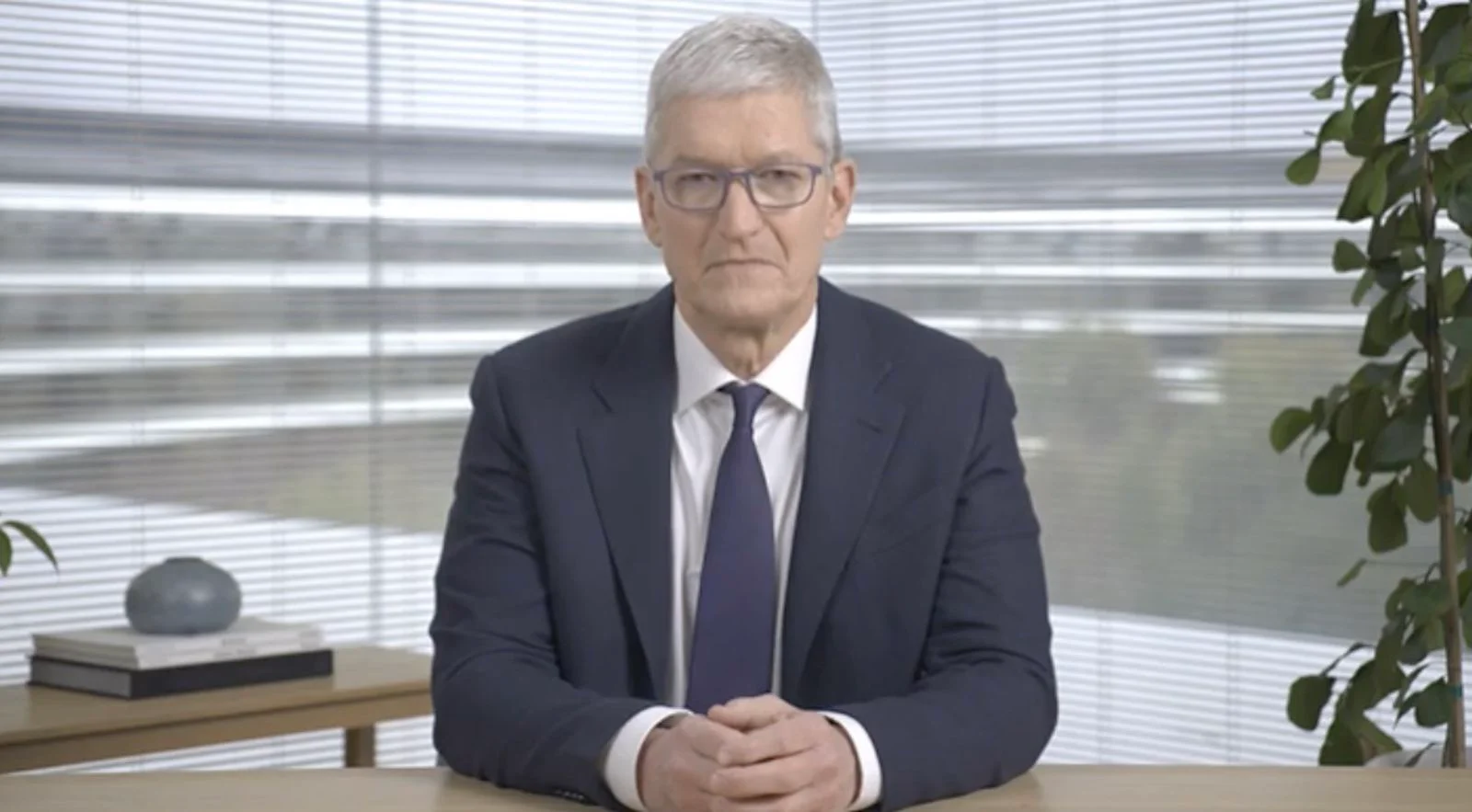

The New York Times reports a 2023 CIA briefing warned a China-Taiwan invasion could disrupt global chip supply and harm both the US and Chinese economies; despite this, Apple and other chipmakers haven’t meaningfully moved production away from Taiwan. Apple is pushing some US manufacturing and TSMC is expanding in Arizona, but advanced nodes still rely on Taiwan. A conflict could trigger significant supply disruptions, though US-led allied production could mitigate some effects.