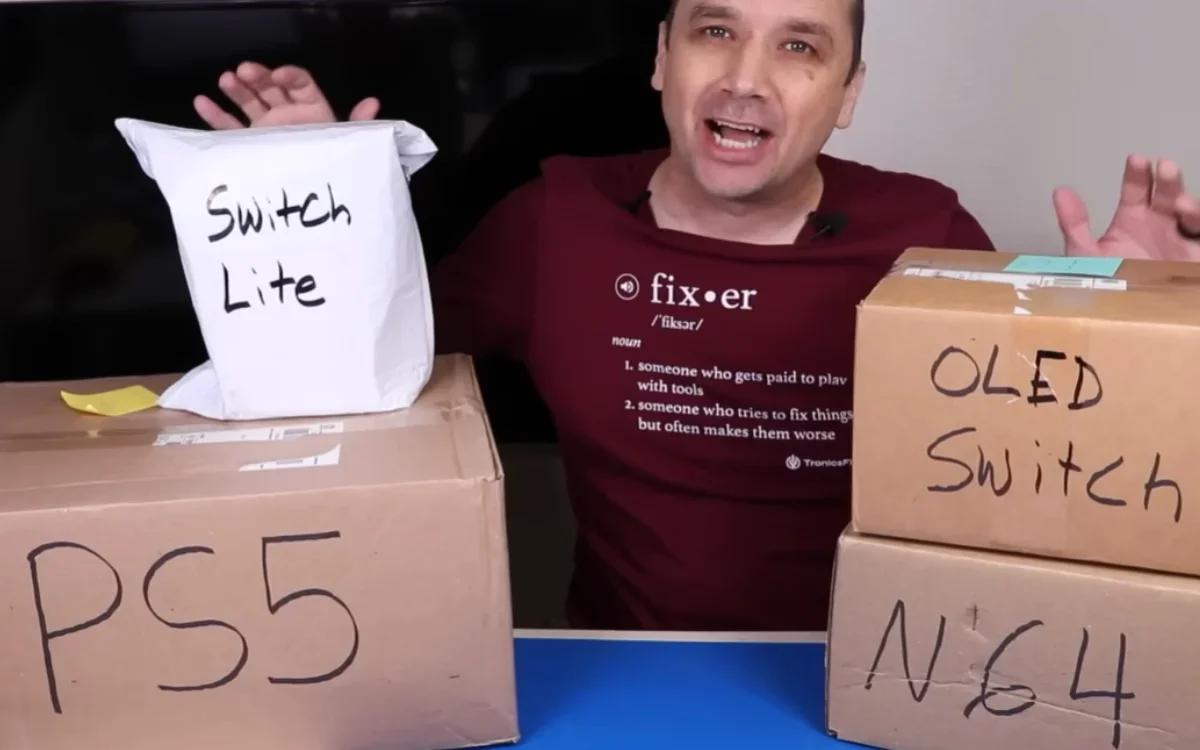

YouTuber Tests Temu’s Refurbished Consoles, Finds Mixed Quality Across Four Machines

An Oregon shopper’s four Temu-purchased consoles—Nintendo Switch Lite, Switch OLED, PlayStation 5, and an N64—were tested by YouTuber TronicsFix. Results showed mixed quality: the Switch Lite looked nearly new but likely wasn’t a true refurb, the N64 was dirty and modified, the Switch OLED appeared used rather than refurbished, and the PS5 was functional but dirty inside; overall, all four worked, suggesting Temu’s “refurbished” listings often mean used and reset rather than professionally serviced.