Morgan Stanley's Profits Soar 14% on Investment Banking Rebound

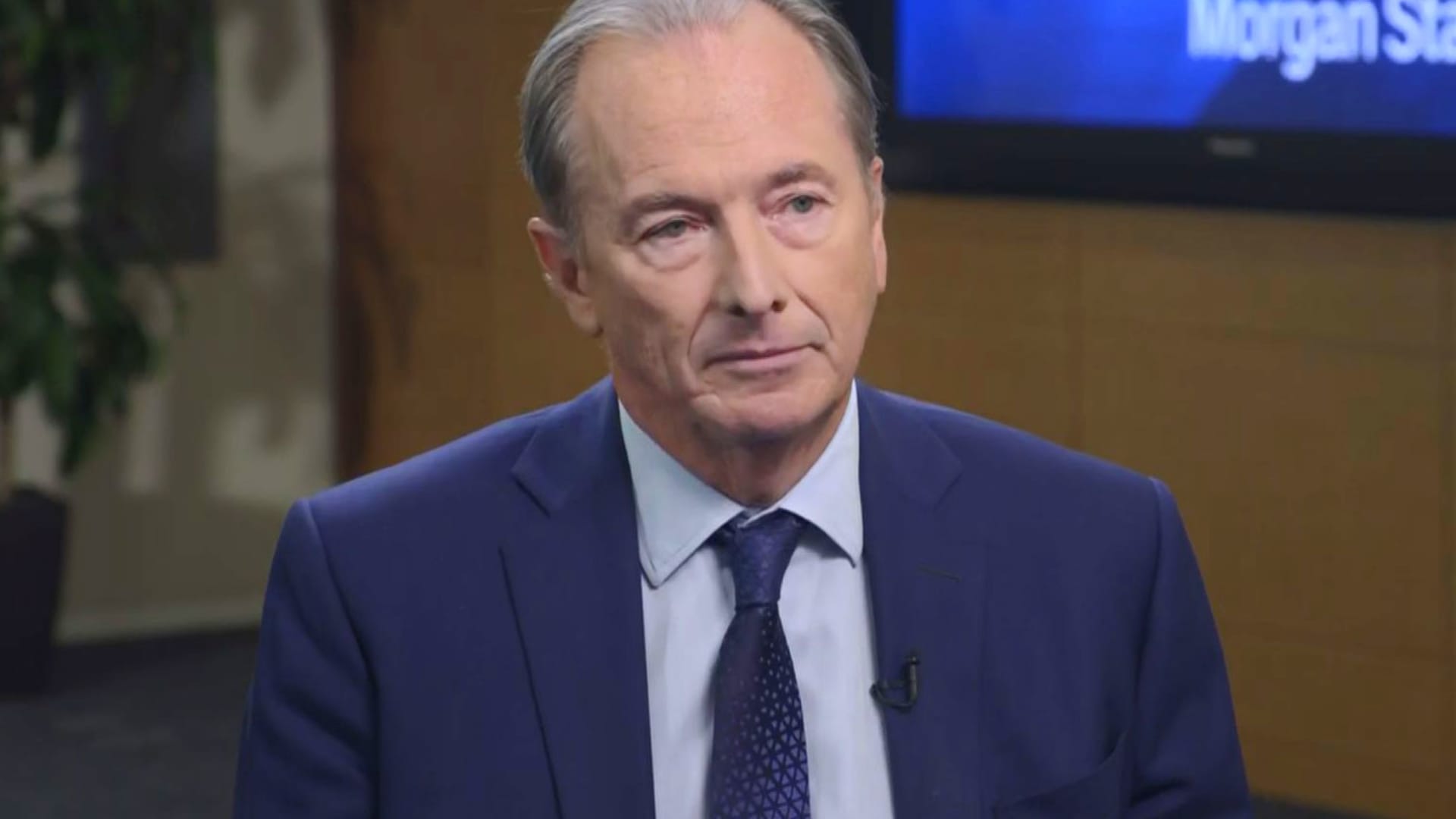

Morgan Stanley's first-quarter profits rose, with net income up 14% from the previous year and 125% from the fourth quarter, exceeding analyst expectations. New CEO Ted Pick received a boost as the Wall Street giant benefited from increases in investment banking, trading, and asset management. The investment banking fees rose 19% from a year ago, driven by equity and fixed income underwriting, while equity and fixed income trading also exceeded expectations. Despite a weak spot in advisory work, the overall performance was better than anticipated, with the stock rising by more than 3% in pre-market trading. The evidence of a revival in dealmaking is starting to emerge in the first-quarter results from big banks, with Wall Street showing signs of a reopening of capital markets.