SCOTUS Lawyer Convicted of Tax Evasion Linked to High-Stakes Poker

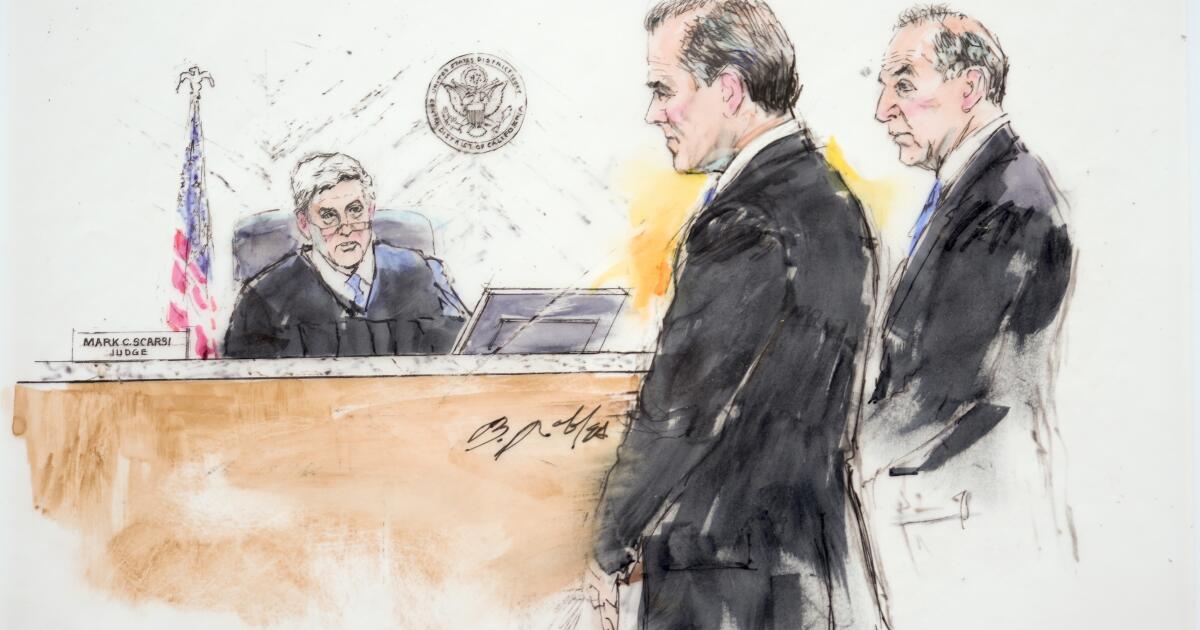

A prominent Supreme Court litigator and SCOTUSBlog founder Thomas Goldstein was convicted on 12 of 16 counts, including tax evasion and false tax return charges, tied to millions in high-stakes poker winnings and alleged diversion of law-firm funds to cover gambling debts; the trial featured testimony from Tobey Maguire.