Nvidia Unveils New AI Chips and Collaborations Amid Industry Competition

Nebius, Supermicro, and CoreWeave are set to offer Nvidia's Vera Rubin computing platform, highlighting advancements in high-performance computing technology.

All articles tagged with #supermicro

Nebius, Supermicro, and CoreWeave are set to offer Nvidia's Vera Rubin computing platform, highlighting advancements in high-performance computing technology.

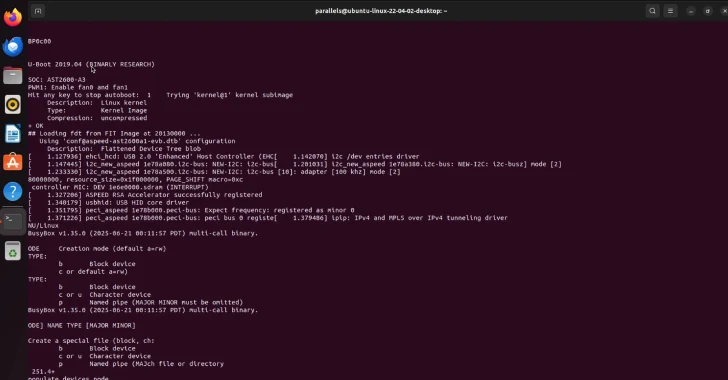

Cybersecurity researchers disclosed two medium-severity vulnerabilities in Supermicro BMC firmware that allow attackers to bypass verification processes and update systems with malicious images, potentially compromising server security and control.

Supermicro unveiled new AI-optimized servers and systems at an event in Madrid, highlighting collaborations with Nvidia and other tech giants, and positioning itself as a key player in the growing AI infrastructure market, with its stock surging over 50% year-to-date.

Supermicro announced new AI-optimized systems at INNOVATE! EMEA 2025, featuring the latest NVIDIA GPUs, Intel processors, and edge solutions designed for high performance and energy efficiency across data centers and edge environments.

Supermicro's stock rose about 5% after launching high-volume deliveries of NVIDIA Blackwell Ultra AI systems and related racks, featuring high-performance solutions for large-scale AI applications, supporting rapid deployment and enhanced efficiency.

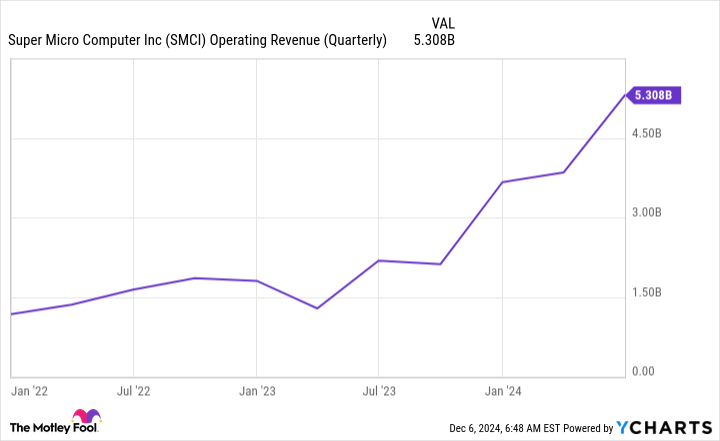

Supermicro reported strong financial growth in FY25 with $22 billion in sales and a net income of $1 billion, driven by AI and datacenter solutions, and projects further growth in FY26 with at least $33 billion in sales.

Super Micro Computer Inc. is at risk of being removed from the Nasdaq 100 Index due to a significant drop in market cap following an auditing scandal. Despite this, CEO Charles Liang remains optimistic, citing strong relationships with clients like xAI and Nvidia as stabilizing factors. While short-term stock performance shows selling pressure, medium-term indicators offer some hope. JPMorgan notes robust orders and no major customer churn, suggesting potential stability. The company's future on the Nasdaq 100 will be decided soon, with competition from firms like Palantir and MicroStrategy.

JPMorgan maintains an Underweight rating on Supermicro with a $23 price target, despite the stock closing at $44.16. After meeting with management, JPMorgan reports that Supermicro's customer base remains strong, with no significant changes in order allocations, countering market speculation. The company is preparing for new product rollouts in fiscal 2025 and reassures that its Malaysia plant will ramp up as planned. Supermicro is confident in managing its working capital for a revenue base of $5.5B-$6B, and its position with Nvidia's Blackwell product line remains robust.

Super Micro Computer Inc.'s stock fell 7.18% in pre-market trading despite CEO Charles Liang's assurances that the company would meet Nasdaq's deadline for overdue financial reports, avoiding delisting. The decline follows J.P. Morgan's underweight rating and a $23 price target, despite strong server orders. Investor confidence has been shaken by an auditing scandal and Ernst & Young's resignation, leading to financial report delays. The stock's volatility reflects ongoing concerns about governance and transparency.

Super Micro Computer's CEO, Charles Liang, assured that the company will meet Nasdaq's February 2025 deadline to file delayed financial reports, addressing delisting concerns. The company faced setbacks after an audit scandal with Ernst & Young, but remains committed to transparency and compliance. Despite these challenges, Super Micro continues to focus on AI infrastructure growth, partnering with Elon Musk's xAI for advanced supercomputing solutions.

Despite facing accounting and financial reporting issues, Super Micro Computer (SMCI) retains a strong customer base, according to JPMorgan analyst Samik Chatterjee. However, investor confidence is waning, with SMCI stock dropping over 6% amid ongoing concerns. The company is addressing these issues by ramping up production and planning new product rollouts, while an independent committee found no accounting wrongdoing. Nevertheless, the stock remains underweight with a price target of 23.

Super Micro Computer, a partner of NVIDIA, is facing stock volatility due to delayed financial reporting and compliance concerns, with an 8.7% drop in shares. CEO Charles Liang is optimistic about maintaining the company's Nasdaq listing by meeting the February 2025 deadline for overdue reports. The company has appointed BDO USA as its new auditor after Ernst & Young resigned over governance issues. Despite a special committee finding no misconduct, investor concerns persist. Super Micro's collaboration with NVIDIA aims to enhance its IT solutions with the NVIDIA Grace CPU Superchip.

Super Micro Computer's stock has experienced significant volatility in 2024, initially soaring due to high demand for its AI server components, similar to Nvidia. However, allegations of accounting fraud and subsequent investigations led to a sharp decline. A special committee found no wrongdoing, leading to a partial recovery, but the stock remains below its peak. Investors are now questioning if it can regain its previous highs.

Super Micro Computer's stock has experienced significant volatility in 2024, initially soaring due to high demand for its AI server components but later plummeting following allegations of accounting fraud. A special committee found no wrongdoing, but the company's financial results have underperformed expectations, and trust remains an issue. Despite clearing some allegations, ongoing investigations and revenue concerns suggest caution for potential investors.

Super Micro Computer Inc.'s stock surged nearly 9% in after-hours trading after Nasdaq granted an extension to file overdue reports by February 25. The AI server manufacturer has faced scrutiny since delaying its annual report, following allegations from Hindenburg Research and the resignation of its auditor, Ernst & Young. A special committee found no misconduct, boosting stock prices. The company is addressing governance issues and searching for a new finance chief, while analysts advise monitoring the acceptance of these findings by new auditors, BDO.