Disney Prepares for Q4 Earnings Amid Streaming and Parks Focus

Walt Disney is set to release its Q4 earnings tomorrow, with options traders anticipating a potential 6.6% price swing in the stock.

All articles tagged with #stock volatility

Walt Disney is set to release its Q4 earnings tomorrow, with options traders anticipating a potential 6.6% price swing in the stock.

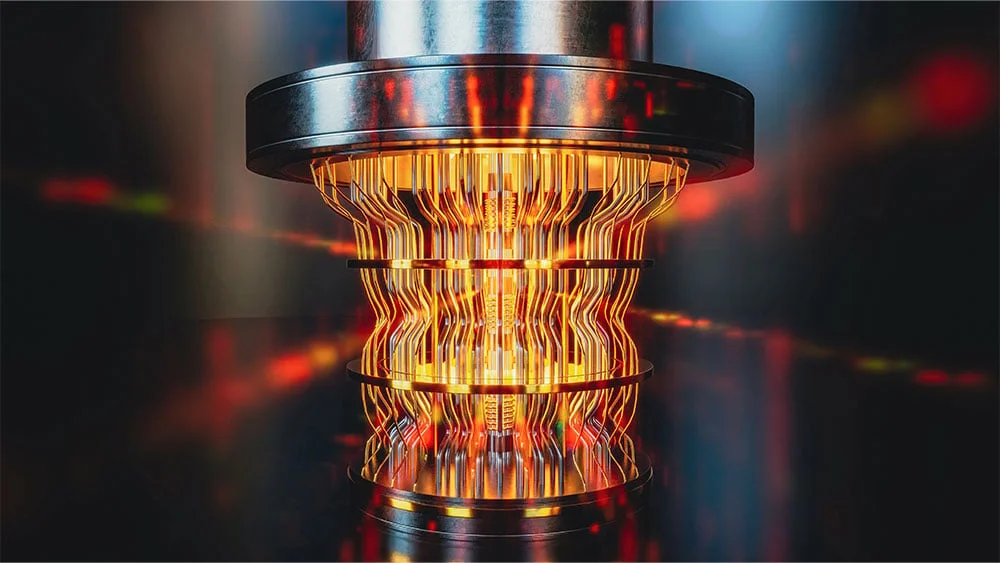

Quantum computing stocks are highly volatile as they approach third-quarter earnings, with IonQ, D-Wave, Rigetti, and Quantum Computing expected to show mixed financial results, primarily focusing on revenue growth and smaller losses. Despite recent gains, these stocks remain unpredictable amid industry competition and technological uncertainties.

Gold prices have surged to a record high above $4,200 amid ongoing stock market volatility, highlighting increased investor interest in safe-haven assets.

The Trump administration is not currently considering taking an equity stake in Critical Metals Corp., despite reports and market volatility caused by speculation. The administration has received numerous deal proposals but is not actively pursuing any, including with Critical Metals, which is involved in Greenland’s rare earths project. Recent government investments in other resource companies highlight ongoing efforts to support critical industries.

Nvidia's venture capital arm has invested in multiple quantum computing startups, including PsiQuantum and QuEra, amid a volatile 2025 for quantum stocks. Nvidia's involvement highlights its interest in integrating quantum computing with supercomputers, despite earlier skepticism from CEO Jensen Huang. Quantum stocks like IonQ and D-Wave have experienced significant fluctuations, reflecting the emerging and uncertain nature of the technology.

Opendoor's stock experienced extreme volatility, soaring nearly 120% before being halted due to a gamma squeeze driven by a surge in call options trading, particularly around the $4.50 strike price, leading to massive trading volumes and rapid price swings amid broader market gains.

Tesla's stock declined slightly after a significant jump following the launch of its robo-taxi service in Austin, Texas, amid safety concerns and ongoing investigations by NHTSA. While the service has received positive reviews, videos showing minor errors have prompted regulatory scrutiny, highlighting the challenges and uncertainties in scaling autonomous vehicle technology. Investors are cautious, comparing Tesla's progress to competitors like Waymo, which has demonstrated safety improvements with more extensive ride data. The future of Tesla's robo-taxi ambitions depends on safety, regulatory approval, and scaling efforts.

Traders expect Oracle's stock to potentially reach a 2025 high following its upcoming earnings report, with a predicted 7.2% move in either direction, influenced by recent gains driven by AI investments and mixed analyst ratings.

Super Micro Computer (SMCI) stock has joined the 'hero to zero' club due to its extreme volatility, experiencing significant gains and losses in consecutive days. Recently, SMCI was the top performer in the S&P 500 with a 16% gain, followed by a 10% drop, making it the worst performer. The stock's volatility is linked to potential Nasdaq delisting, a new auditor, and AI-related market movements. Despite a 23% rise this year, analysts have a consensus Hold rating on SMCI.

Some retirees have heavily invested in Trump Media stock, despite its volatility and significant losses. One investor, who put 98% of his retirement funds into the stock, remains optimistic due to a supposed 'secret' plan by Trump and the company's CEO. Although the stock saw a temporary surge, it remains unstable, with Trump Media facing financial challenges and declining revenue. The company's future is uncertain, especially as Trump's return to mainstream platforms diminishes the unique appeal of Truth Social.

Traders betting on a potential takeover of Cytokinetics Inc. experienced a rollercoaster ride as rumors and reports of buyer interest caused the stock to soar nearly 200%, only to be followed by sharp declines when no bid materialized. Pharmaceutical companies like Novartis AG and AstraZeneca Plc are reportedly considering a buyout, leading to significant stock volatility. With the company's market value close to $10 billion, analysts are skeptical about the likelihood of a merger announcement and advise investors to carefully consider their positions amidst the uncertainty.

Stock volatility reached a six-month peak as the CBOE Volatility Index, or "fear index," surged by approximately 10%, closing at a level not seen since March 2023. The escalation of the conflict between Israel and Gaza, along with a U.S. Navy warship intercepting missiles from Yemen, contributed to heightened caution in the financial markets. Bond performance continued to lag as yields rose, and the iShares 20+ Year Treasury Bond ETF closed at its lowest level since May 2006. Equity markets also saw a notable drop, while gold acted as a safe haven. The U.S. State Department issued a travel warning amid rising risks of tensions and terrorism attacks.