Bitmine's ETH Hoard Reaches 4.29 Million Amid $10.7B Crypto & Cash Treasure

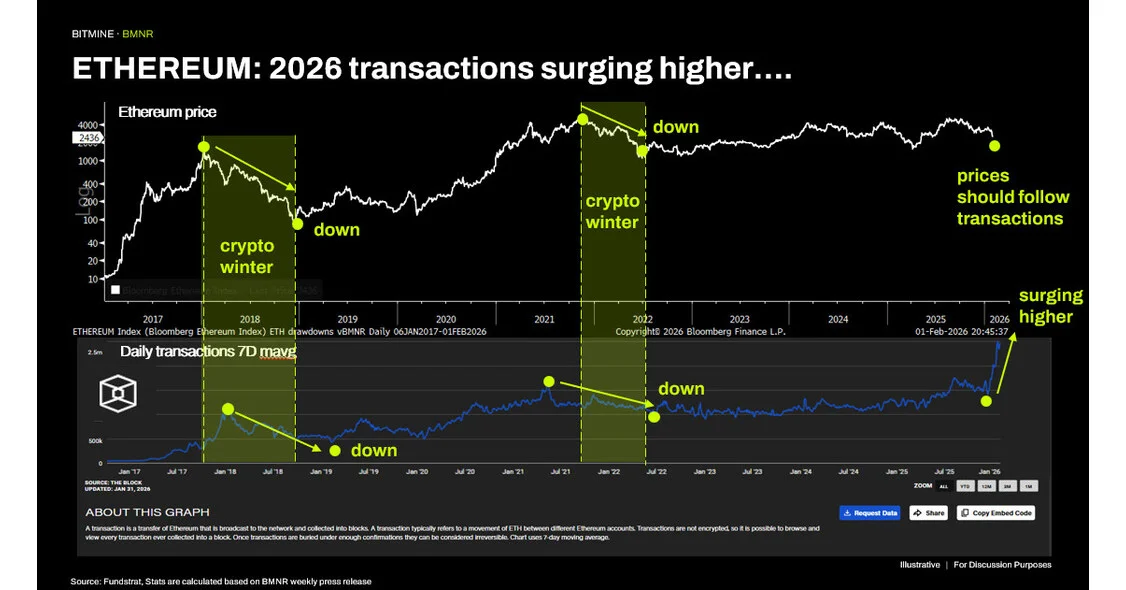

Bitmine Immersion Technologies reports total crypto+cash holdings of $10.7 billion, anchored by about 4.29 million ETH (roughly 3.55% of supply), 193 BTC, a $200 million Beast Industries stake, a $20 million Eightco stake, and $586 million in cash. About 2.897 million ETH are staked, yielding $188 million in annualized staking revenue (with MAVAN potentially pushing rewards to around $374 million once deployed). MAVAN is planned for early 2026. The company remains a leading ETH treasury with strong trading liquidity and backing from major institutional investors.