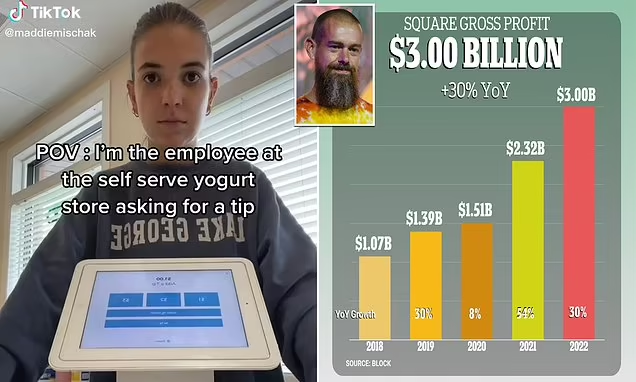

Block's mass layoff births a 3,800-strong ex-employee Slack ‘Square Mafia’

After Block cut more than 4,000 jobs (nearly half the workforce), an unaffiliated Slack channel created in 2016 called Square Mafia has grown to about 3,800 former Block staffers who use it to network, share job leads, swap referrals, and commiserate with memes; a bot handles queries, membership rules emphasize real names and leaving Block, and members help each other with LinkedIn connections and benefits, including visa-related job transitions for those on H-1B visas.