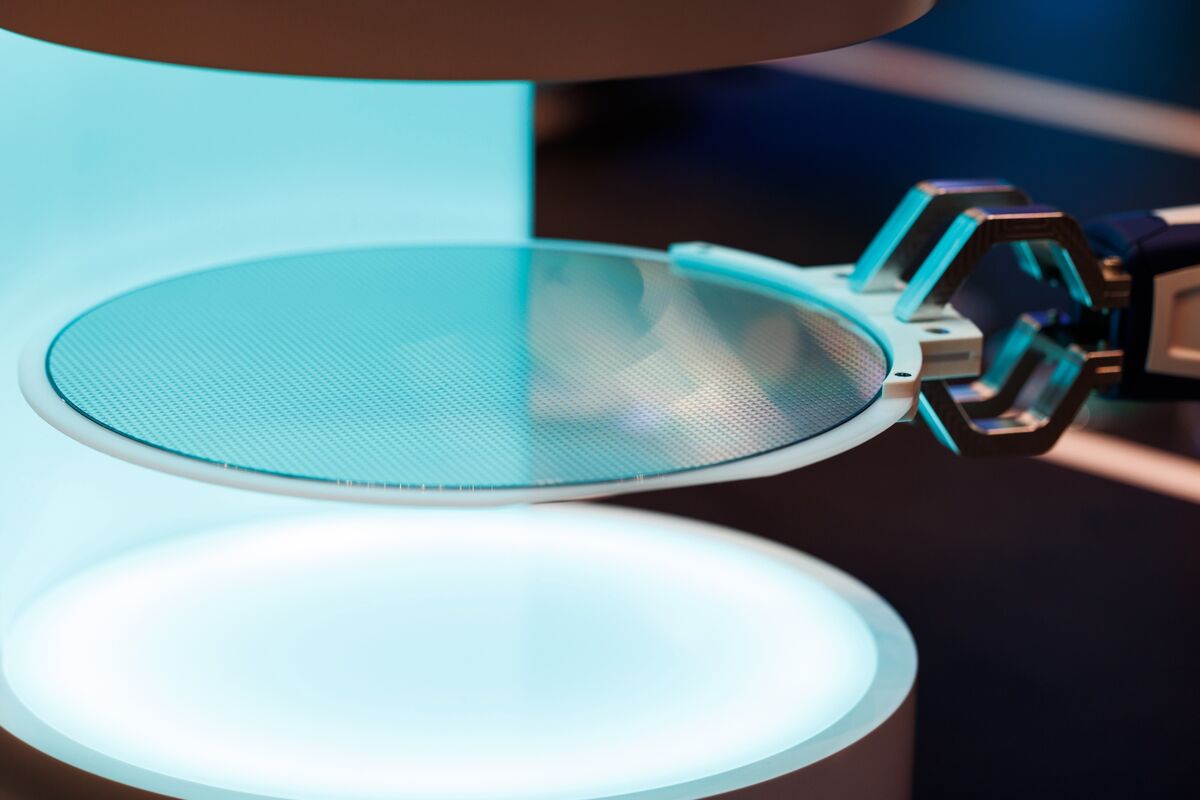

Chip-Scale Phonon Laser Promises Single-Chip Radios

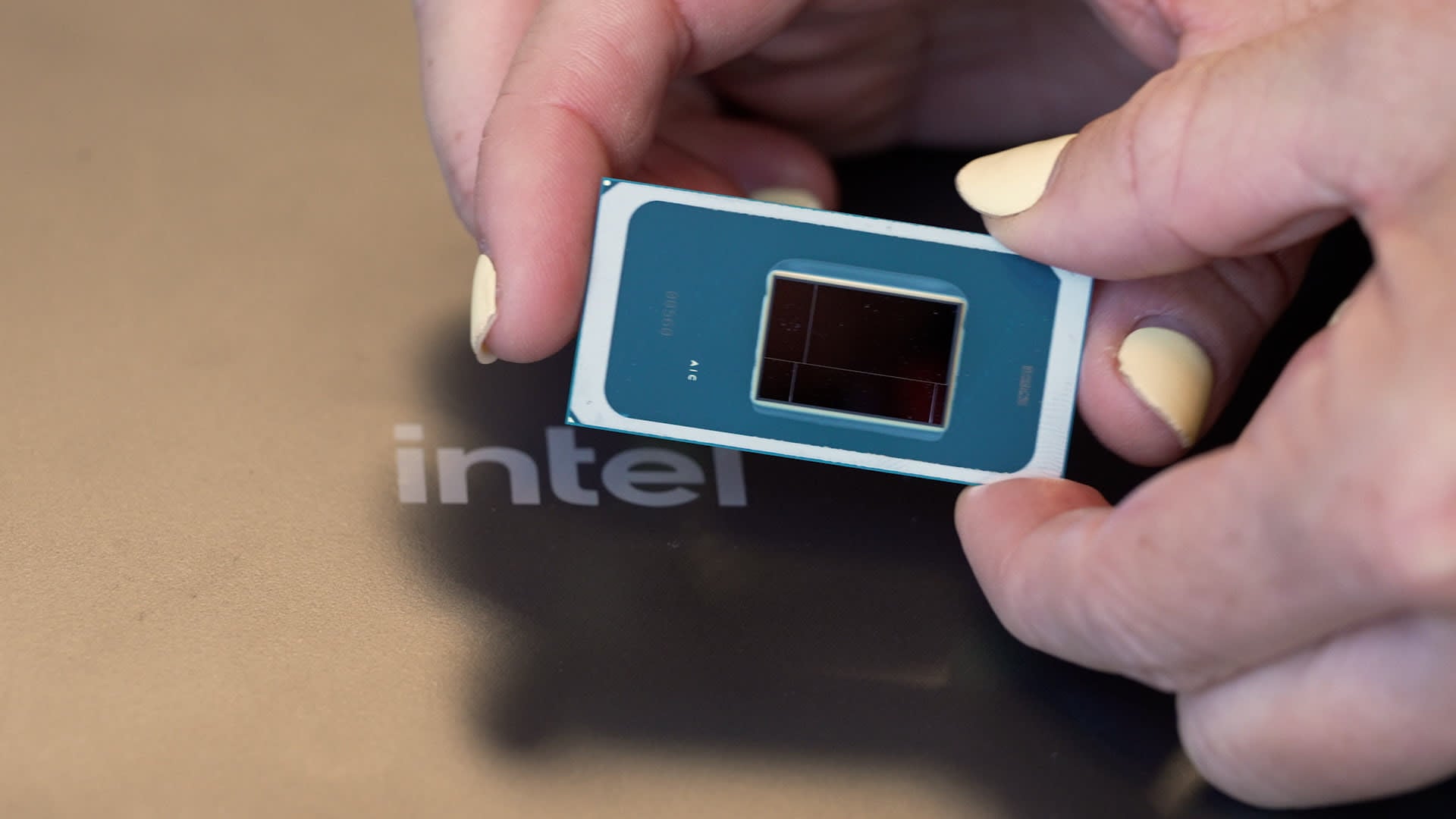

Researchers demonstrated an electrically driven surface acoustic wave phonon laser on a chip, generating gigahertz SAWs that could enable all radio processing on a single, smaller, more power-efficient smartphone chip.