"China's Market Regulator Overhaul: Xi's Focus on Control Amid Stock Market Meltdown"

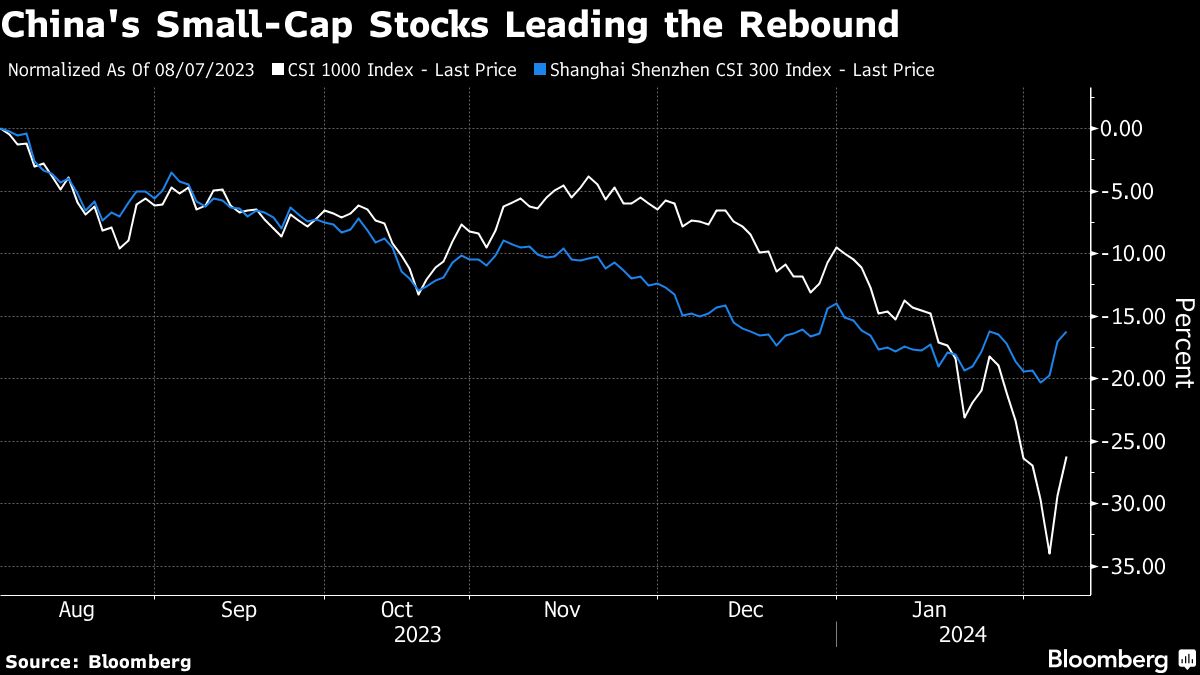

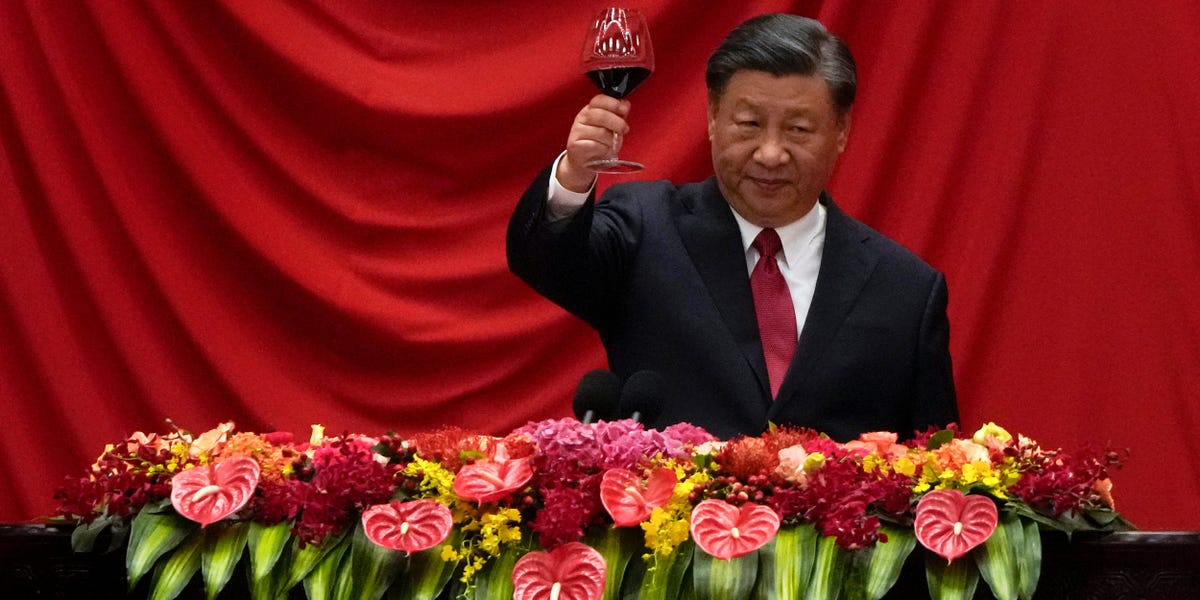

Chinese President Xi Jinping's decision to replace the head of the China Securities Regulatory Commission reflects a focus on tightening administrative controls rather than addressing core economic challenges, as the country's stock markets continue to struggle. The move comes amid significant market losses and a lack of clarity on policy direction, with analysts emphasizing the need for economic reforms to bolster investor confidence and support a convincing recovery. The unexpected personnel change signals Xi's prioritization of control, raising concerns about the potential impact on China's economy and the need for more extreme measures in the face of systemic financial risks.