"Maximizing Returns: The Low-Volatility Appeal of REIT Investments"

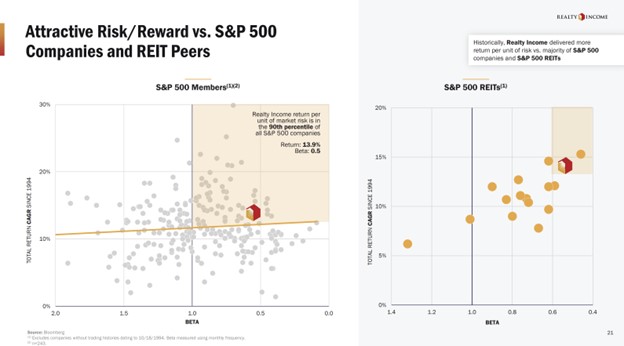

Real estate investment trusts (REITs) like Realty Income, Essex Property Trust, and Public Storage have historically outperformed the S&P 500 with less volatility. These REITs have stood out for their ability to produce high returns with lower risk, driven by factors such as stable cash flow, strong credit ratings, and focus on housing-constrained markets. Their durable business models and strong financial profiles make them reliable long-term investments for investors seeking less volatile options compared to the broader market.