"Maximizing Returns: 10 Key Benefits of Diversified REIT Investments"

TL;DR Summary

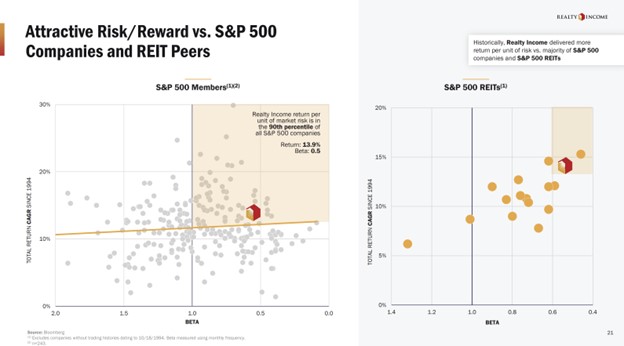

Real estate investment trusts (REITs) like Realty Income, Essex Property Trust, and Public Storage have historically delivered strong returns with less volatility compared to the S&P 500. These REITs have stood out for their ability to produce high returns with lower risk, driven by factors such as stable cash flow, strong financial profiles, and focus on less volatile real estate sectors. Investors seeking reliable long-term investments may find these REITs appealing due to their track record of delivering consistent returns with lower volatility than the broader market.

- Looking for a Reliable Investment? These 3 REITs Are Less Volatile Than the S&P 500. Yahoo Finance

- 5 Benefits of Investing in REITs Yahoo Finance

- Follow The Money (Blackstone): 3 Strong Buy REITs Seeking Alpha

- GLPI: Top 4 Diversified REITs for Future Success StockNews.com

- 10 Things You Should Know About REITS Kiplinger's Personal Finance

Reading Insights

Total Reads

0

Unique Readers

6

Time Saved

4 min

vs 5 min read

Condensed

90%

908 → 87 words

Want the full story? Read the original article

Read on Yahoo Finance