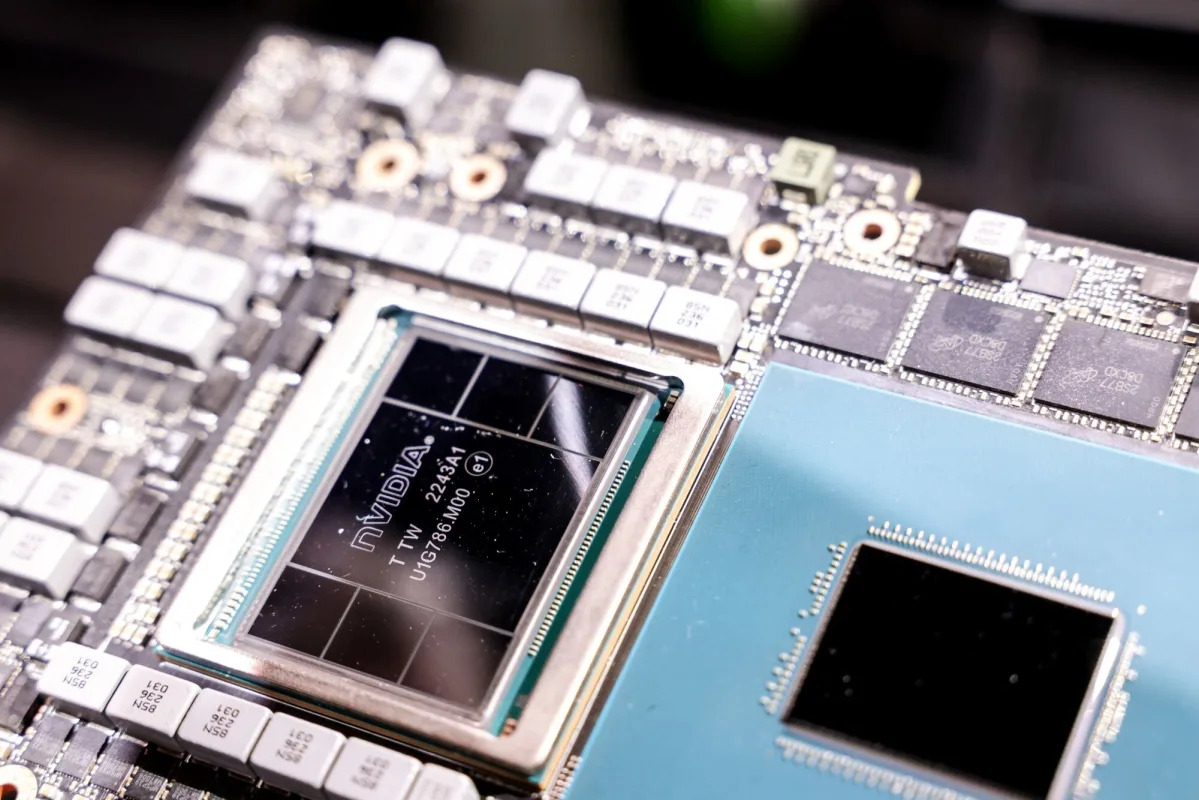

"Nvidia's Soaring Stock Sparks Speculation of Market Bubble"

Options trading in semiconductor stocks, driven by the AI market frenzy, has doubled in volume, with daily average notional volume exceeding $145 billion in February. Nvidia Corp. accounted for almost four-fifths of the trades, with its market value soaring and pulling the semiconductor index up by more than 23%. The rapid expansion in options trading may indicate investors playing catch up after missing out on last year’s rally, and options offer a way to bet on further gains in chip makers while providing protection if the rally slows down.