"Americans' Retirement Savings Fall Short of Comfortable Living: Study"

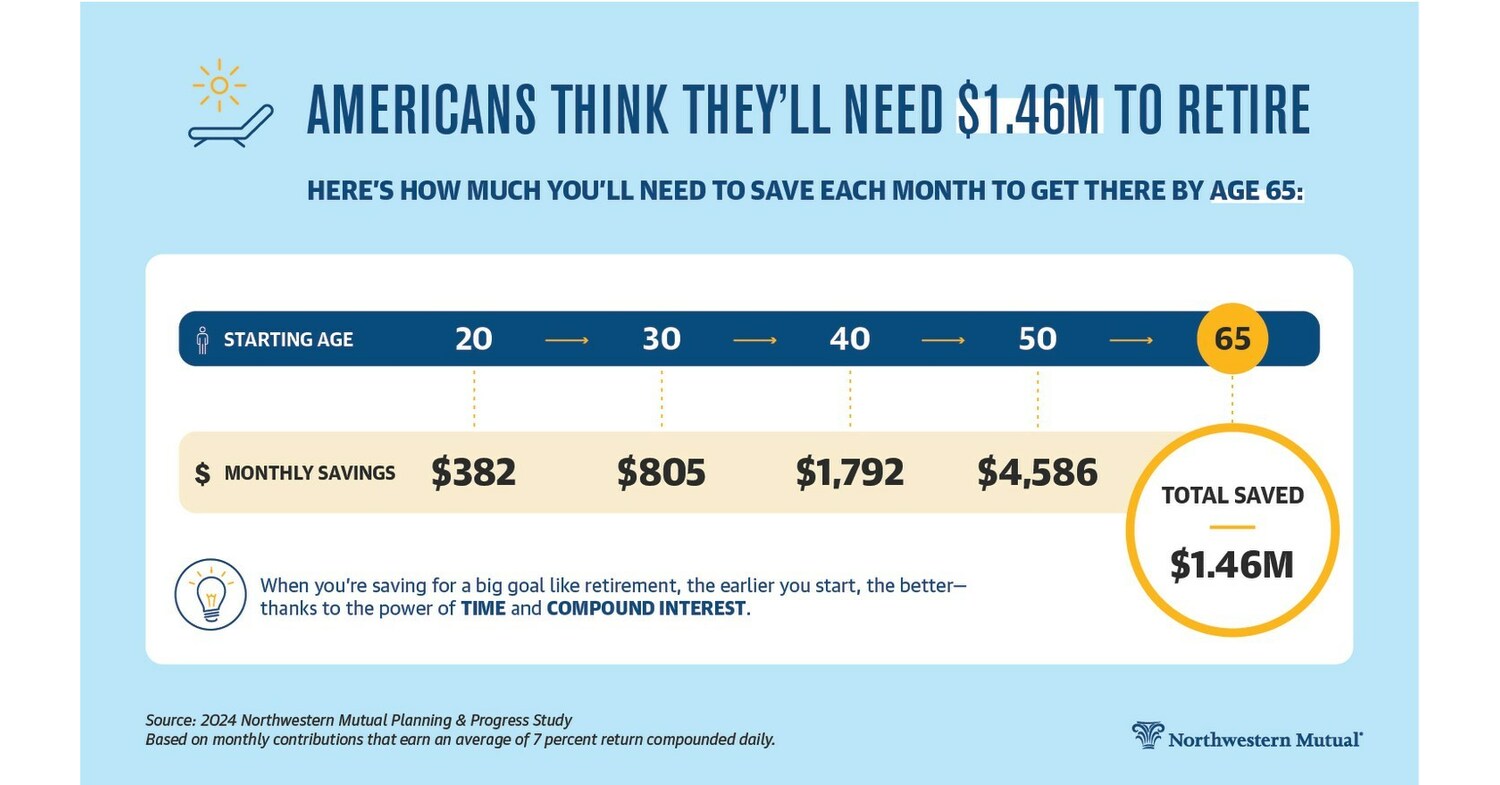

A recent study by Northwestern Mutual revealed that while many Americans believe they need around $1.46 million saved for retirement, the reality is that most have significantly less, with an average of less than $89,000 saved. Inflation has further impacted retirement savings, widening the gap between individuals' retirement goals and their actual progress. The study also highlighted that many Americans, particularly those aged 40-59, have substantial disparities between their perceived retirement savings needs and their actual savings. Additionally, a survey found that only 40% of "Gen X" workers know exactly how much they will need to retire. Furthermore, New York and New Jersey were ranked as some of the worst states to retire in due to high costs of living and healthcare expenses.