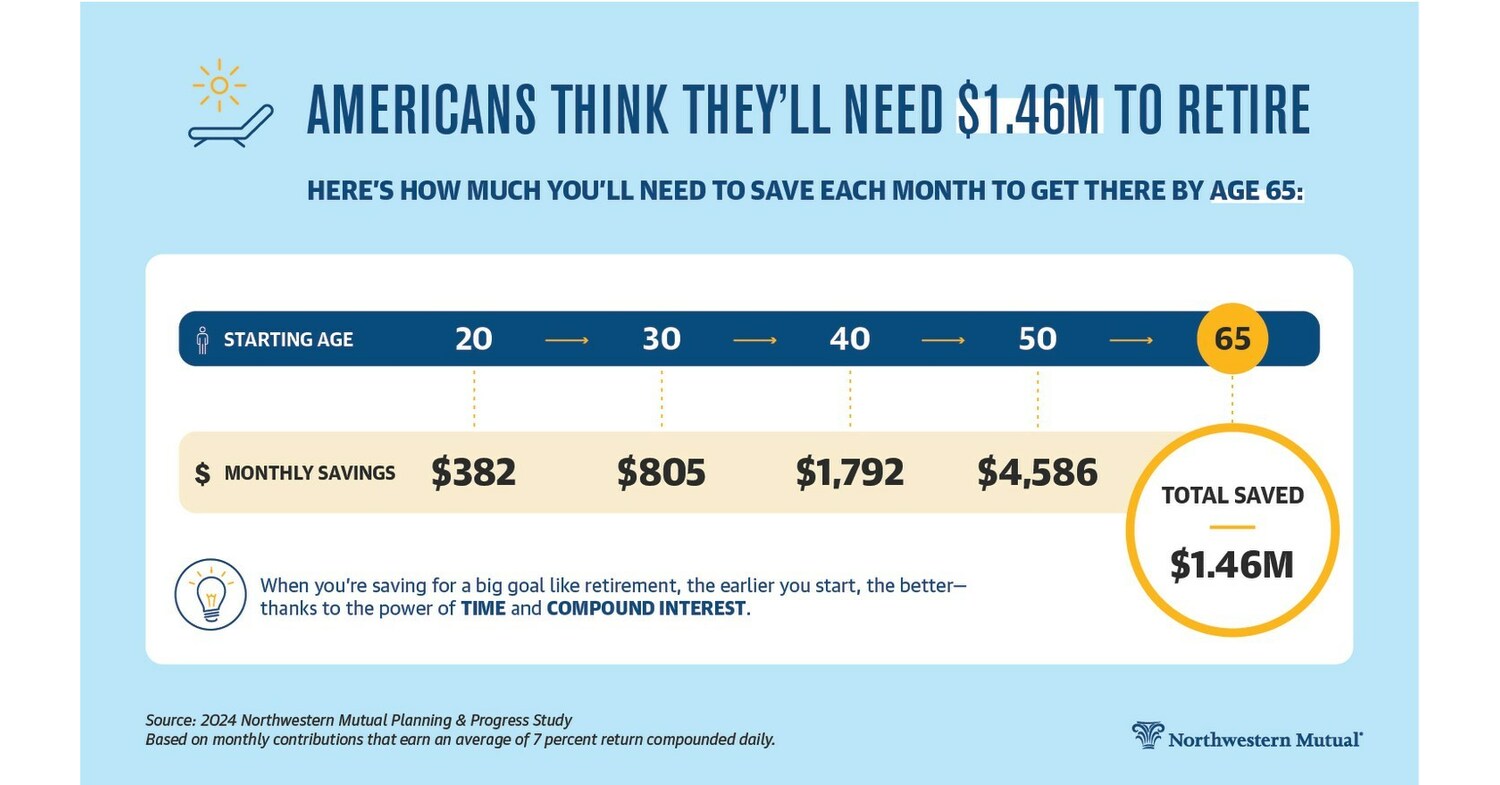

"Record High: Americans' $1.46 Million Retirement Comfort Goal"

According to Northwestern Mutual's 2024 Planning & Progress Study, Americans believe they will need $1.46 million to retire comfortably, a 15% increase from last year and a 53% increase since 2020, outpacing inflation. The average amount U.S. adults have saved for retirement dropped to $88,400, while high-net-worth individuals say they'll need nearly $4 million. Gen Z started saving at 22 and expects to retire at 60, while Boomers+ started saving at 37 and expect to retire at 72. The 'Silver Tsunami' of 11,000 Americans turning 65 every day through 2027 is putting pressure on retirement planning, with only half of Boomers+ and Gen X believing they'll be financially ready for retirement. Additionally, just 3 in 10 Americans have a tax-efficient retirement plan, potentially causing them to pay more in taxes than required.

- Americans Believe They Will Need $1.46 Million to Retire Comfortably According to Northwestern Mutual 2024 Planning & Progress Study PR Newswire

- Retirement crisis looms as Americans struggle to save CNN

- Americans Think They Need $1.46 Million to Retire Comfortably The Wall Street Journal

- How much do you need in your 401(k) for a comfortable retirement? The new 'magic number' is well over $1million Daily Mail

- The amount of money Americans think they need to retire comfortably hits record high: study USA TODAY

Reading Insights

0

1

9 min

vs 10 min read

93%

1,853 → 132 words

Want the full story? Read the original article

Read on PR Newswire