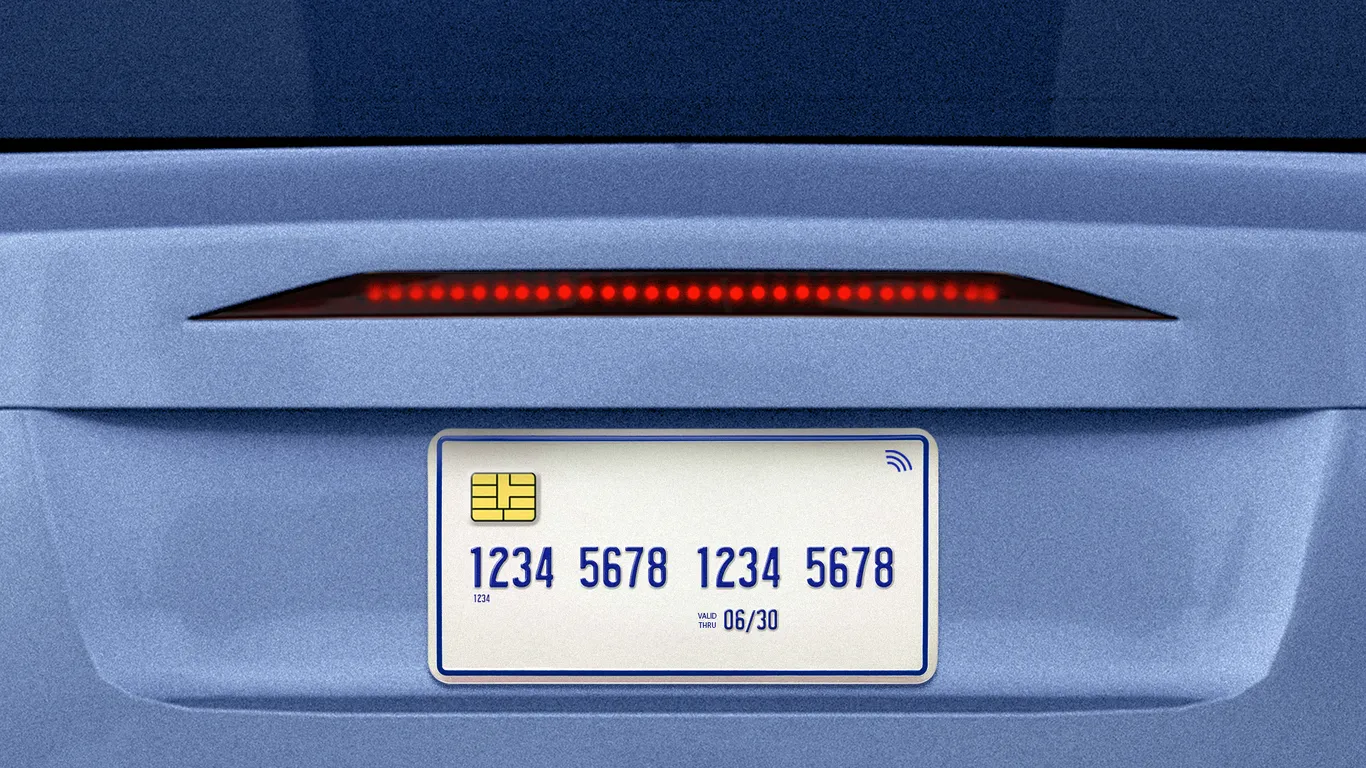

Record Auto Debt Pushes Buyers Underwater as Negative-Equity Reaches All-Time High

Edmunds data shows U.S. buyers are drowning in negative equity on new-car trades: Q4 2025 averaged $7,214 underwater, with 29.3% of trade-ins underwater—an all-time record. The piece argues dealers’ use of “creative” financing and consumer demand for larger, feature-rich vehicles help drive the problem, a trend the industry is finally acknowledging as affordability becomes unsustainable. A personal anecdote about financing a $40k truck with a $25k value and poor credit highlights how predatory-feeling practices can be, and the story notes that EV buyers have also faced large underwater loans. The author suggests buyers lower expectations and spending, while automakers and dealers must prioritize real affordability to curb rising debt.